-

Earning consumer trust in the age of agentic commerce

Understanding how AI assistants are reshaping the buyer journey.

Executive summary

Visa conducted research to understand how consumers are adapting to the rise of agentic commerce: the emerging world where AI acts on their behalf when shopping and buying. This report summarizes the results of that research covering the United States, Australia and New Zealand. The full dataset can be found in the Appendix at the end of this report.

Across all three markets, consumers show striking consistency: most are already familiar with AI-powered shopping assistants,¹ and approximately one in three expect to use them regularly.² From discovery to checkout, AI is beginning to automate everyday buying decisions—and consumers are defining what makes those experiences trustworthy.

Three themes stand out

Visa research suggests that agentic commerce is no longer theoretical. It is a measurable shift in consumer behavior with the potential to significantly reshape how value moves through the digital economy. This report outlines how consumers are engaging with AI agents, what motivates or limits their use and how Visa Intelligent Commerce empowers agents to deliver reliable and secure experiences at every step.

-

Understand consumer familiarity, adoption, motivators, barriers and brand effect on perception and purchase related to AI-assisted shopping.

-

15-minute online survey via AYTM agile consumer insights platform, among adults 18–65 who shop online monthly and hold a debit or credit card.

-

Measure “agentic substitution”— where AI tools replace or augment human decisions at each stage of the buyer journey.

-

Respondents were shown a video to illustrate the e-commerce shopping experience assisted by AI in four use cases (birthday gift, groceries, travel, electronics).

-

Nationally representative online surveys (United States n=1,600; Australia n=1,600; New Zealand n=500).

Our approach

We looked at how people in three markets would actually use an AI shopping assistant, from finding what they need to hitting “buy.” Through four everyday shopping categories, we explored when and why people might let an AI agent step in to handle the tasks they normally do themselves.

Three regions studied

- United States (n=1,600)

- Australia (n=1,600)

- New Zealand (n=500)

Source: Visa Agentic Commerce Consumer Research Surveys — U.S., Australia, New Zealand (2025)

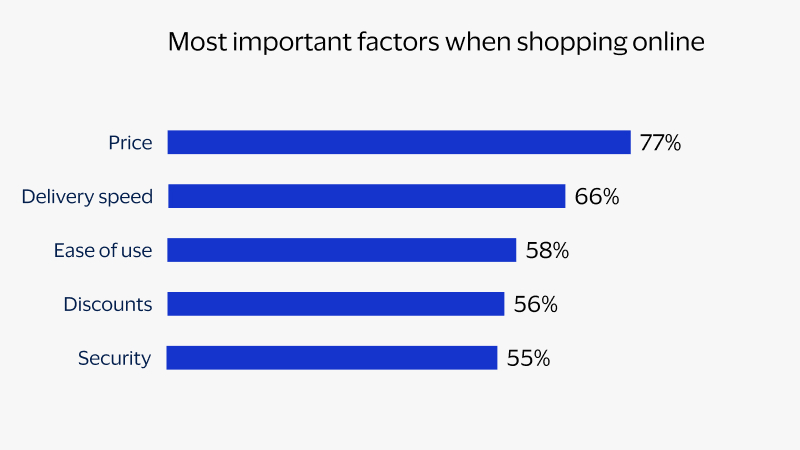

Consumers across markets appear pragmatic. They want efficiency and control: less time spent searching and more assurance over how data is used.¹

United States

Key insight

Familiarity with AI assistants is high (55%), and adoption is steady. Confidence correlates with understanding: those who know how agents work are most likely to delegate tasks.³

Implication

U.S. consumers reward brands that make AI-driven transactions transparent and reversible. Fraud protection, refund policies and recognizable payment providers remain critical.⁴

Australia

Key insight

Australia leads in adoption (59% familiarity; 44% likely to use). Price sensitivity drives behavior. Australian survey respondents use agents to compare deals and optimize value, but transparency is non-negotiable; over half would abandon an agent if data use was unclear.⁵

Implication

Providers that demonstrate how tokenization safeguards data will maintain a competitive edge as adoption scales.⁶

New Zealand

Key insight

Familiarity is lower (43%) but growing. One-third of respondents in New Zealand say they’re likely to try an AI agent within a year. Convenience and time savings outweigh novelty; users are pragmatic, not experimental.⁷

Implication

Hybrid experiences that pair human support with AI efficiency can help early adopters build confidence and trust.⁸

Buyer journey stages and substitution rates

-

Discovery

Initial awareness, interest and early stage product exploration.

Substitution rate

73%

Tasks replaced:

Search engine, site browsing, social media and online ads.

-

Evaluation

Comparing options, assessing sellers and preparing to purchase.

Substitution rate

69%

Tasks replaced:

Browsing different retailers, reading reviews and social media research.

-

Cart and checkout

Confirming selections, looking for offers and completing payment.

Substitution rate

62%

Tasks replaced:

Add to cart, shipping information and applying discounts.

-

Post-purchase

Awaiting delivery, returning, registering and reviewing.

Substitution rate

64%

Tasks replaced:

Tracking shipments, managing returns and warranty registration.

Control is the currency of trust

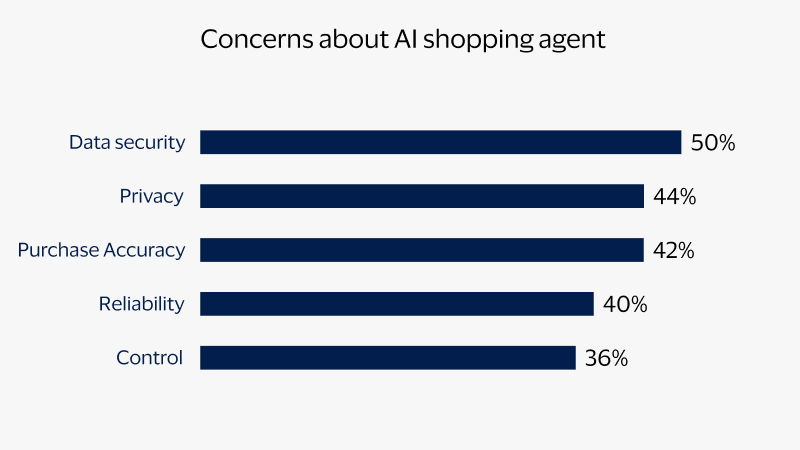

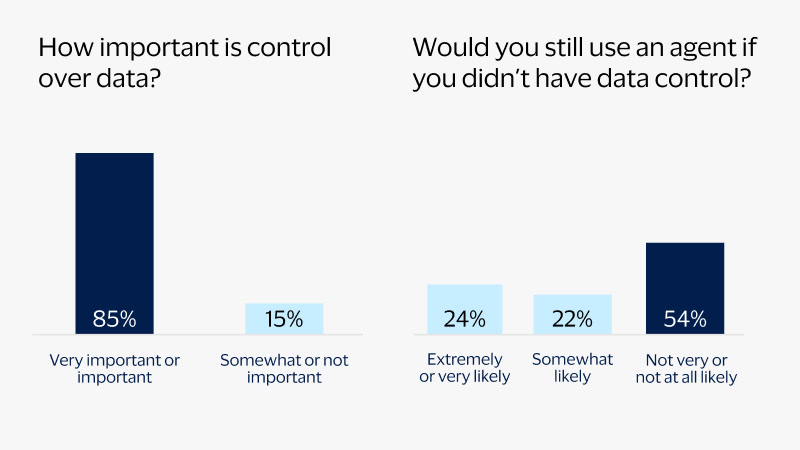

While consumers indicate they want AI to assist with some of the more time-consuming aspects of e-commerce like comparison shopping, there’s still a strong desire for oversight. Roughly 85% of American respondents say it’s important that they have visibility into data collection and the ability to customize or delete their shopping and purchase information which is consistent with other markets.⁹

Average substitution rate per buyer journey stage based on average of all use cases (Birthday gift, electronics, groceries and travel) across all markets (U.S., AU and NZ) and weighted by sample size (U.S. n=1600, AU n=1600, NZ n=500).

Drivers of adoption

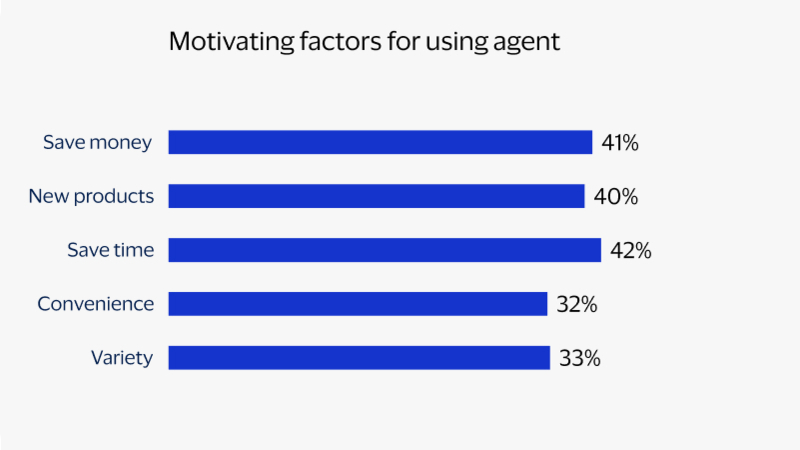

Across markets, consumers view AI agents as tools, not novelty.¹⁰

- Automating repetitive tasks such as price comparison or reordering.

- Access to better deals and personalized recommendations.

- Reducing decision fatigue through relevant, filtered options.

What this means for payments and you

Agentic commerce is changing how key participants in the payments ecosystem create and sustain trust.

Consumers' expectations are changing. Merchants, issuers, acquirers, wallets and developers must collaborate to optimize agentic commerce. This means building the standards, data connections and guardrails that make agentic commerce safe and scalable.

Turning the agentic shift into strategic advantage

Across markets, more than a third of consumers indicated being more likely to shop with retailers offering agentic purchasing options; a clear signal that early infrastructure investment is likely to pay off.¹²

As one of the world’s leading payment networks, Visa is positioned to turn this shift into shared advantage. The company’s tokenization, security and interoperability standards already underpin much of digital commerce; extending these to agentic environments helps to support safe and scalable innovation.

Visa Intelligent Commerce connects issuers, acquirers, wallets, developers and AI platforms through shared trust protocols which can transform fragmented innovation into cohesive, reliable systems.

Trusted companies to provide AI

The three most common brands selected across markets were PayPal, Amazon,and Visa, indicating consumers may be more comfortable with shopping agents that originate from recognizable brands in the e-commerce space. Other brands receiving 20% or better aggregate interest include Apple, Google and Mastercard while about one in five U.S. consumers said they would not feel comfortable using a shopping agent from any of the listed companies.¹³

Building the next era of commerce, together

Agentic commerce is accelerating from possibility to practice.

The question is no longer whether consumers will use AI agents, but which ecosystem players consumers and agents will trust and ultimately use. Visa Intelligent Commerce can help develop and extend trust through the global standards, infrastructure and security that let innovation move safely and scale seamlessly.

Visa invites partners and potential partners to learn more about Visa Intelligent Commerce

Together, we can develop the trust, governance and interoperability that makes agentic commerce safe at scale and turn early adoption into durable advantage.

Disclaimer: Case studies, comparisons, statistics, research and recommendations are provided “AS IS” and intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice. Visa neither makes any warranty or representation as to the completeness or accuracy of the information within this document, nor assumes any liability or responsibility that may result from reliance on such information. The Information contained herein is not intended as investment or legal advice, and readers are encouraged to seek the advice of a competent professional where such advice is required.

- Figures 1.1, 1.2, 3.1 from Visa Agentic Commerce Consumer Research Surveys — U.S., Australia, New Zealand (2025)

- Figures 1.6, 2.6, 3.6 from Visa Agentic Commerce Consumer Research Surveys — U.S., Australia, New Zealand (2025)

- Figures 1.1 to 2.1 from Visa Agentic Commerce Consumer Research Surveys — U.S., Australia, New Zealand (2025)

- Figures 1.11 to 1.16 from Visa Agentic Commerce Consumer Research Surveys — U.S., Australia, New Zealand (2025)

- Figures 2.1, 2.11, and 2.15 from Visa Agentic Commerce Consumer Research Surveys — U.S., Australia, New Zealand (2025)

- Figure 2.13 from Visa Agentic Commerce Consumer Research Surveys — U.S., Australia, New Zealand (2025)

- Figures 3.1, 3.6, and 3.11 from Visa Agentic Commerce Consumer Research Surveys — U.S., Australia, New Zealand (2025)

- Figure 3.13 from Visa Agentic Commerce Consumer Research Surveys — U.S., Australia, New Zealand (2025)

- Figure 1.15 from Visa Agentic Commerce Consumer Research Surveys — U.S., Australia, New Zealand (2025)

- Figures 1.12, 2.12, and 3.12 from Visa Agentic Commerce Consumer Research Surveys — U.S., Australia, New Zealand

- Figures 1.13, 2.13, and 3.13 from Visa Agentic Commerce Consumer Research Surveys — U.S., Australia, New Zealand (2025)

- Figures 1.17, 2.17, and 3.17 from Visa Agentic Commerce Consumer Research Surveys — U.S., Australia, New Zealand (2025)

- Figures 1.16 2.16, and 3.16 from Visa Agentic Commerce Consumer Research Surveys — U.S., Australia, New Zealand (2025)