Authentication is better today, but can be even better tomorrow

Improvements in authentication have reduced fraud; but also introduced friction into the online checkout experience. Visa Payment Passkey is built to Fast Identity Online (FIDO®) standards and represents the next step in card not present (CNP) authentication—with a host of valuable benefits.

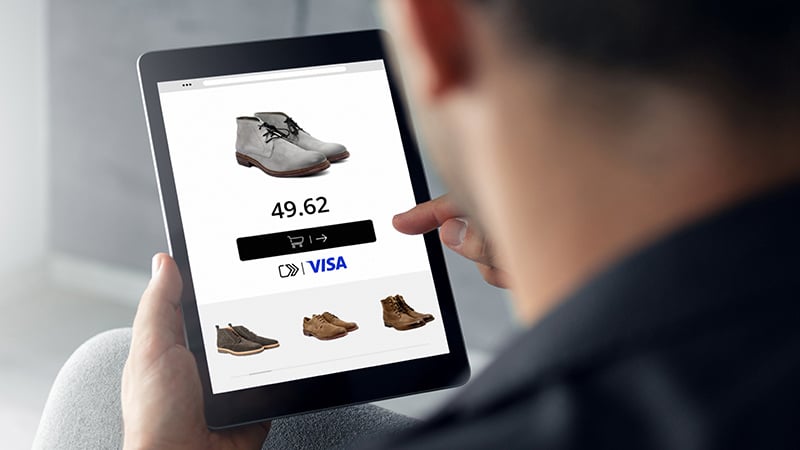

Improved checkout experience

- Strong, device-based payment authentication

- Enabled across all participating merchants

- Single consumer registration

Integrated with Visa solutions

- Guest checkout through Cardinal Consumer Authentication

- A new standard for online checkout from Click to Pay

- Secure card on file through Visa Token Service

Robust compliance

- Strong Customer Authentication

- Can be used with EMV® 3-D Secure (3DS)

- Helps meet PSD2 SCA requirements in the EU

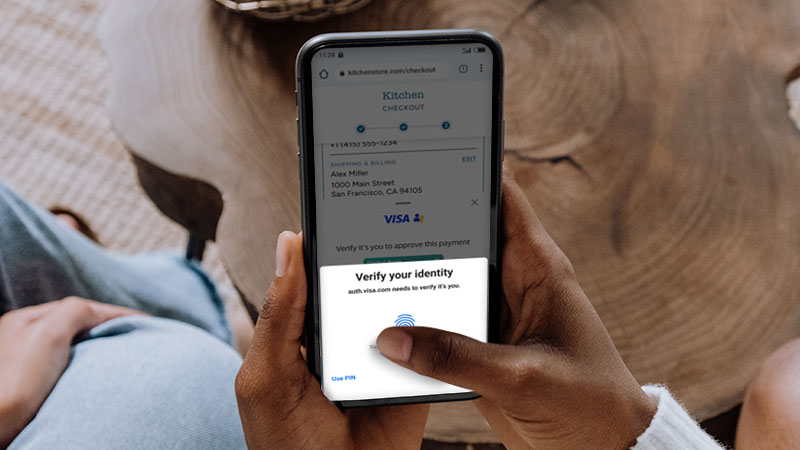

Visa brings passkeys to payments

FIDO2 is a global standard for strong authentication. Established by a consortium of the world’s leading technology companies, including Visa, this solution stores the authentication credential, or passkey, locally on the consumer’s device and uses the consumer’s native device biometric capability or screen lock to authenticate the consumer. Visa is applying this strong authentication to the payment experience.

- Analysis based VisaNet data globally, from July-December 2023, comparing biometric authentication to step-up through OTP sent over text message.

- FIDO Alliance: https://fidoalliance.org/fido2-2/fido2-web-authentication-webauthn/ and https://caniuse.com/?search=FIDO2 (as of Aug 30, 2024).

- FIDO Alliance: https://fidoalliance.org/wp-content/uploads/2021/10/FIDO-ALLIANCE-Response-to-NIST-IOT-Consumer-labelling-October-2021.pdf

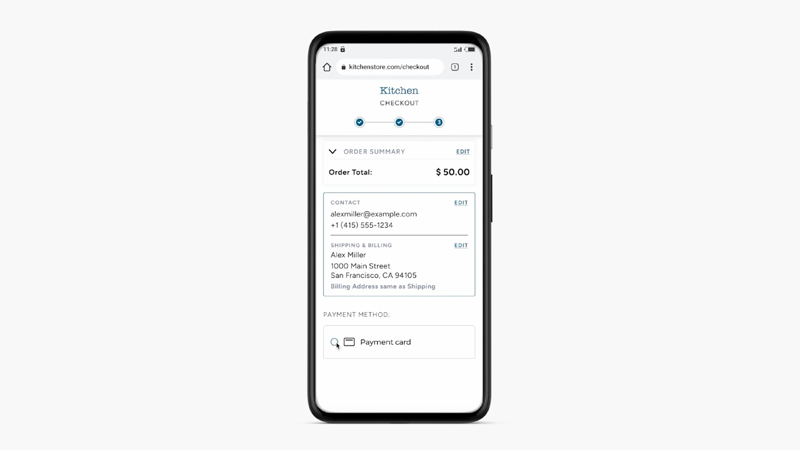

See Visa Payment Passkey in action

Visa Payment Passkey requires a one-time consumer set-up to bind their device. Once their Visa Payment Passkey is set up, it can be used to authenticate the consumer when they checkout at a participating merchant.