Overview

While the adage “time is money” may be familiar (and intuitive) to many, the ability to quantify this concept can be illusive. Thankfully, new research by Garcia-Swartz, Latham, Tzanetaki, Cormier, and Diniz provides a helpful framework to better understand the value of time when it comes to payments. In their paper, The Social Value of Innovation in Payments, the authors provide models for quantifying the social benefits generated from two recent payment innovations: contactless payments and tokenization. Of particular interest for this report is the novel methodology for estimating the time-saving benefits generated by contactless payments on transit systems. These payments can be made using contactless cards, mobile wallets, and wearable devices that utilize near-field communication technology to enable the exchange of payment-related data with a merchant’s point-of-sale device.

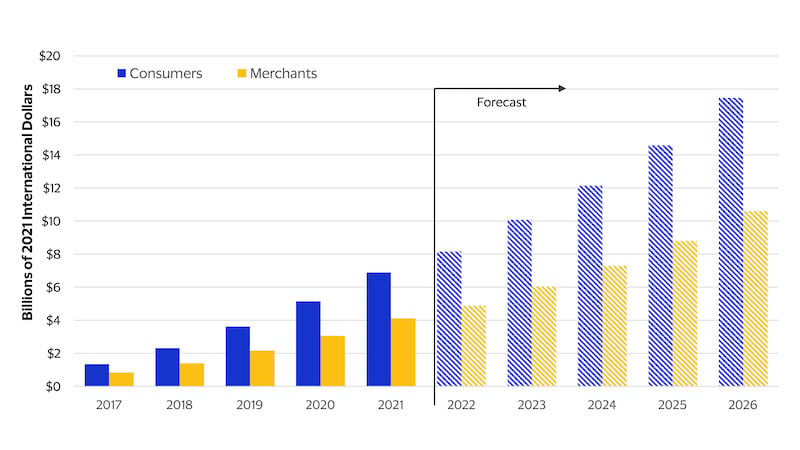

Measuring the benefit for consumers is relatively straightforward. Garcia-Swartz et al. determine the difference in time it takes to transact with a contact card (or with cash) compared to a contactless card and multiplies it by the opportunity cost of time, represented by the average wage for consumers. One study from Norges Bank (cited in the report) estimates that contactless card payments are completed in about half the time (7.8 seconds) compared to those of contact cards (14.8 seconds). Ultimately, the report’s analysis includes transactions from 67 countries and suggests that between 2017 and 2021, time-saving benefits for consumers equaled $19.3 billion, with savings of several more billion forecasted over the next few years (see Figure 1). In order to compare benefits calculated in numerous currencies, these savings are expressed in 2021 international dollars, which utilize purchasing power parity (PPP) conversion factors to derive exchange rates from local currencies into U.S. dollars.

For merchants, time-saving benefits from contactless innovation can be measured in two ways. The first method keeps the amount of time and overall wage costs constant and assumes that merchants can process more transactions since contactless transactions are faster. The second method keeps the number of transactions constant while the amount of time and wage costs are reduced owing to the speedier nature of contactless transactions. Although the authors chose the second approach because it is more conservative, their calculations still suggest that merchants saved $11.6 billion between 2017 and 2021, while forecasted estimates of future savings amount to billions more. As with consumer savings above, merchant savings are based on transactions from the same 67 countries and expressed in 2021 international dollars, using PPP conversion factors.

Figure 1: Annual time-saving benefit from contactless

Helping consumers avoid the queue

Although the $30.9 billion in total estimated time savings for consumers and merchants from 2017 to 2021 is notable, understanding the specific abstract method used to derive these values is not necessary to appreciate their social benefits. Instead, recent surveys and trend data for transportation and urban mobility provide helpful context on exactly how much consumers and merchants value the time-saving benefits from contactless payments.

Anyone that has navigated a transit system knows that it can take time to stand in line to purchase a ticket or load money onto a special card that can only be used on closed-loop systems operated by a specific transit authority. Indeed, a survey cited in the Visa 2020 Transforming Urban Mobility report showed that “84 percent of travelers in major U.S. cities were frustrated by customers ahead of them taking a long time to purchase a ticket and 67 percent reported missing a train due to long ticket lines.”

Alternatively, the use of contactless, open-loop payment systems allows transit riders to skip the line and pay for fares by simply tapping their credit, debit, or prepaid card—or utilize a payment-enabled device on their smartphone or smartwatch. In fact, the experience of a faster and more efficient payment option was cited as a top benefit of contactless payments by 57 percent of transit riders surveyed in the Visa Economic Empowerment Institute (VEEI) 2023 report, Reimagining ridership.

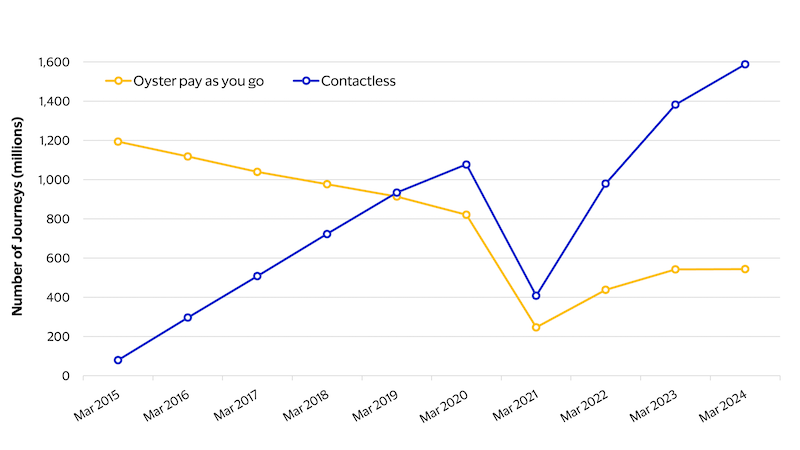

Evidence from Transport for London (TfL)—an early adopter of contactless, open-loop payment systems—highlights that riders are increasingly choosing the contactless payment option over the Oyster pay as you go (closed-loop) card. Between March 2015 and March 2024, the compound annual growth rate (CAGR) for the total number of journeys on the London Public Transit system paid for using contactless payment cards was 39.6 percent (see Figure 2). Meanwhile, the usage of Oyster cards halved, experiencing CAGR rates of -8.4 percent over the same period.

Figure 2: Total journeys on London public transit

Improving merchant productivity

When calculating the benefit of contactless payment innovation for merchants, the authors of The Social Value of Innovation in Payments assumed that the introduction of contactless payments would allow merchants to reallocate labor to non-payment related tasks, thereby improving employee productivity and ultimately benefiting the merchant. Indeed, a representative from CalTrans, California’s transportation agency, confirmed this assumption in Reimagining ridership, explaining that contactless, open-loop payment systems get agencies “out of the business of payments so that they can focus on their key job of moving people around. Payments take up an inordinate amount of transit agency bandwidth. Transit agencies are spending a lot of time on something that should be easy for them, but traditionally it hasn’t been.”

By instituting contactless payments—and focusing employee labor on “moving people around”—transportation agencies can reduce costs associated with fare collection. According to Transforming Urban Mobility, the average cost of collecting a physical dollar was 14.5 cents, while a digital dollar cost 4.2 cents to collect. Ultimately, the same Visa report suggests that transportation agencies can reduce the cost of collecting fares by more than 30 percent by instituting contactless payments.

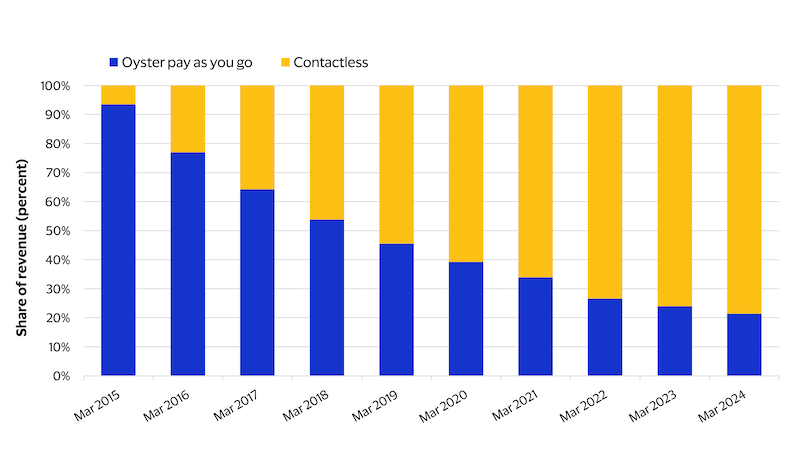

Returning to our TfL example, the share of the transit authority’s revenue generated by contactless, open-loop payments has increased significantly, accounting for almost 80 percent in March 2024—compared to less than 10 percent in March 2015 (see Figure 3). According to Reimagining ridership, the TfL has correspondingly experienced “a sharp fall in fare collection costs since implementing open-loop payments.”

Figure 3: Share of revenue on London public transit

Conclusion

The Social Value of Innovation in Payments underscores the substantial and multifaceted value of contactless payment innovations. By quantifying time savings for both consumers and merchants—amounting to an estimated $30.9 billion between 2017 and 2021, the study highlights how even small increases in transaction speed can translate into significant economic benefits. These gains are not merely theoretical; real-world applications, such as in urban transit systems, demonstrate how contactless payments enhance convenience, reduce operational costs for transit systems, and improve user satisfaction. The case of TfL exemplifies this shift, with a rise in contactless usage and a corresponding drop in the costs associated with collecting fares. As more cities and merchants adopt open-loop, contactless systems, the potential for further savings and improved service delivery continues to grow. Ultimately, the research makes a compelling case for viewing payment innovation not just as a technological upgrade, but as a driver of broader economic and social value by truly saving time and money.