Overview

Digital asset technology, in the form of distributed ledgers and cryptocurrency, has been around for almost 15 years—following the publication of the bitcoin white paper in October 2008. But the benefits this technology could bring to the payments ecosystem only really started to be understood in the wake of Libra’s introduction in June 2019. Even though Libra never materialized, its vision of creating a global currency for the billions of Facebook (now Meta) users around the world highlighted for central banks and traditional financial institutions the potential impact this technology could have on the wider financial ecosystem.

Although cryptocurrencies remain popular investment assets – as witnessed by bitcoin’s price recently topping more than $110,000 in May 2025 – their relatively high levels of price volatility have historically precluded them from being effective mediums of exchange. Recognizing this limitation, digital asset technology evolved with the creation of assets designed to hold a stable value against a specific currency or commodity, for example.

These “stablecoins” are typically issued by private entities on public, permissionless blockchains and categorized based on their stability mechanism. Fiat-backed stablecoins—those that hold high quality, fiat-denominated, liquid assets (such as cash, sovereign bonds, or commercial paper) to maintain stability against a specific currency—are by far the most prevalent, accounting for more than 90 percent of all stablecoins currently issued, according to data from DeFiLlama. Less prevalent are stablecoins using cryptocurrencies or algorithms to maintain stability.

Recognizing the potential advantages of the distributed ledger technology utilized by stablecoin issuers while also acknowledging the possible loss of monetary sovereignty and financial stability risks associated with the use of assets that remain largely unregulated in many jurisdictions, central bank around the world have been exploring the issuance of their own central bank digital currencies (CBDCs). As currently designed, CBDCs would be a central bank liability that would be limited to regulated financial institutions (e.g., wholesale CBDC) or distributed through financial institutions to end user consumers (e.g., retail CBDC).

Concerns about potential financial stability risks associated with stablecoins and the limited availability of viable, production-ready CBDC solutions today has prompted increased focus on yet another iteration of digital asset technology, namely tokenized deposits. Though largely experimental at the moment, tokenized deposits are effectively the tokenization of commercial bank deposits utilizing distributed ledger technology (DLT)-based platforms.

All three of these solutions—fiat-backed stablecoins, CBDCs, and tokenized deposits—are exploring the use of digital asset technology to increase efficiency, improve transparency, enhance security, and boost financial inclusion. Nonetheless, each is currently at a different phase of exploration, issuance, and adoption. This brief report provides an update on each of these three digital asset solutions, utilizing publicly available data to assess current performance against important metrics.

Current estimates from the Atlantic Council suggest that 134 countries—representing 98 percent of global GDP—are exploring some version of a CBDC. Surprisingly, however, a live production-version CBDC exists in only three countries: the Bahamas, Jamaica, and Nigeria.

Furthermore, the recent high-profile executive order prohibiting “the establishment, issuance, circulation, and use of a CBDC” in the United States is illustrative of headwinds that may also exist in other jurisdictions contemplating CBDC issuance. Indeed, one-third of central banks surveyed by OMFIF have delayed their CBDC issuance timeline, citing issues related to economic considerations and political will. Despite these delays, three-quarters of the central banks in the OMFIF survey still expect to issue a CBDC, with more than half planning to increase internal resourcing dedicated to exploring and/or implementing a CBDC.

As central banks evaluate the various CBDC design options, including wholesale CBDC limited to regulated financial institutions and retail CBDC available to end users, the current experience of live CBDC initiatives offer valuable insights and suggest some challenges in advancing the adoption of CBDC, particularly retail CBDC.

By 2021, retail CBDCs were launched in the Bahamas, Jamaica, and Nigeria, with all three central banks citing financial inclusion and the modernization of domestic payment systems as motivating factors. All three CBDCs are based on a two-tiered system in which the central bank is in charge of issuing the CBDC and financial institutions are responsible for distributing CBDC to end users and conducting compliance checks. However, not all of the CBDCs utilize DLT. While the Bahamas and Nigeria opted for private, permissioned blockchains, Jamaica decided to use a centralized ledger system.

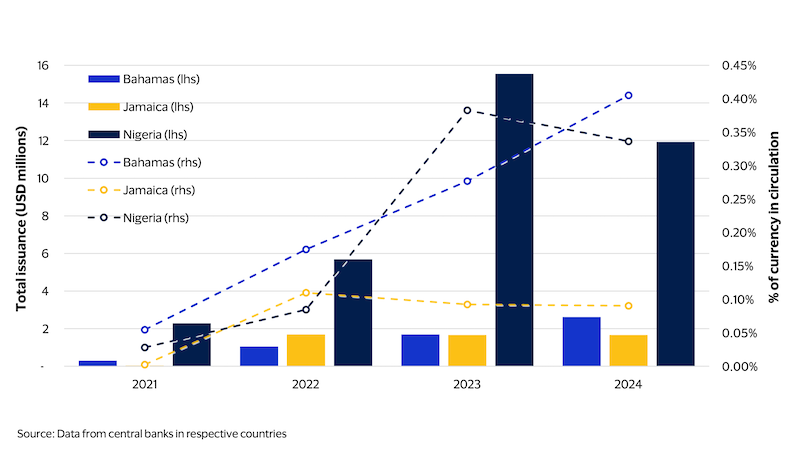

Data from all three central banks shows that consumer adoption remains very low, despite the implementation of various incentive programs. Total issuance in Jamaica has remained flat at around $1.6 million, while the Bahamas saw a modest increase to $2.6 million. Nigeria’s CBDC also witnessed decent growth, with overall issuance climbing to NGN 18.3 billion in 2024 from NGN 0.9 billion in 2021—though it should be noted that US dollar equivalents (as highlighted in Figure 1) were impacted by a significant devaluation of the Nigerian naira against the US dollar in 2024. Perhaps most notable, especially considering retail CBDCs are often billed as “digital cash”, is the fact that all three CBDCs represent only a fraction of a percent of the Currency in Circulation (e.g. physical banknotes, or cash) currently outstanding in each country.

Apprehension about adoption is one of the factors considered by those central banks still evaluating CBDC options, with 56 percent of the emerging market participants in the OMFIF survey citing low adoption as the biggest concern about launching a retail CBDC. Recent survey results from the European Central Bank (ECB) indicate that 58 percent of consumers would be unlikely or very unlikely to use a digital euro (i.e., retail CBDC) for retail payments. This suggests low adoption could also be a concern for developed markets. Since lack of consumer awareness and education on the benefits of CBDC is one the main reasons for low adoption, according to a Federal Reserve Bank of Kansas City report, central bankers might need to more carefully consider the needs of end users before launching a retail CBDC.

Figure 1: Retail CBDC in circulation

Fiat-backed Stablecoins

The total supply of fiat-backed stablecoins—digital assets issued on blockchain networks and designed to maintain a stable value relative to a specific currency (e.g. US dollar)—increased approximately 40 percent over the 12 months ending in April 2025, reaching record high levels of more than $219 billion, according to Visa data (via Onchain Analytics Dashboard). With 99.8 percent of all fiat-backed stablecoins pegged to the US dollar, the stablecoin market is heavily influenced by U.S. dynamics, as highlighted by the fact that three-quarters of the stablecoin gain noted above came after U.S. elections in November 2024, during which digital assets were prominently discussed.

The consideration by U.S. policymakers for new legislation centered on stablecoins as well as digital asset market infrastructure , is adding further support to the broader stablecoin industry. Indeed, Brian Moynihan, CEO of Bank of America, told the Economic Club of Washington DC that his bank could launch its own stablecoin once regulation was passed in the U.S.

However, regulation may not necessarily be the determining factor in stablecoin supply. After the adoption in Europe of the Markets in Crypto Assets (MiCA) Act in June 2023, there was no noticeable increase in euro-denominated stablecoin issuance. But the total supply of euro stablecoins did jump 40 percent following increased economic uncertainty amid the announcement of various tariffs that began in April 2025, according to DeFiLlama data. Nonetheless, stablecoins pegged to the euro account for less than 0.2 percent of the total, according to DeFiLlama.

While the growth of US-dollar-pegged stablecoins may be noteworthy for countries worried about the potential dollarization of their economies, especially following the U.S. executive order promoting the “development and growth of…dollar-backed stablecoins worldwide” [emphasis added], some U.S. officials suggest increased usage could also “create potentially trillions of dollars of demand for U.S. Treasuries, which could lower long-term interest rates.”

Although most stablecoin reserves are invested in U.S. Treasuries, they represent less than one percent of the $28 trillion in U.S. Treasury securities outstanding. Furthermore, stablecoin reserves usually hold assets with less than three months of remaining maturity, which would likely limit the ability to materially impact long-term interest rates. A recent Citi report estimates stablecoin supply could rise to between $500 billion and $3.7 trillion by 2030, with approximately 90 percent pegged to the US dollar. If outstanding U.S. Treasury securities grow by the 7.45 percent compound annual growth rate witnessed over the past 11 years, stablecoin reserves could either stay at less than one percent of outstanding Treasuries or grow to represent approximately 6 percent, according to the author’s calculations.

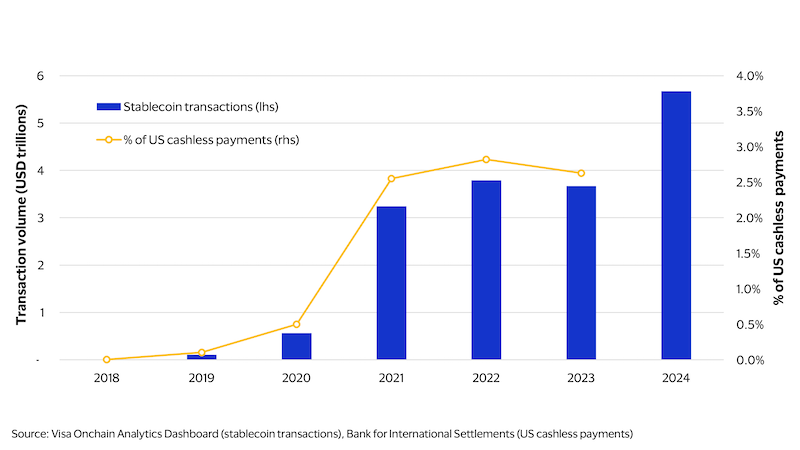

Stablecoin transaction volume data can be overstated due to activity from high-frequency trading and bots. Data on the Visa Onchain Analytics Dashboard removes these potential distortions, providing a more realistic estimate. Stablecoin transactions have increased significantly, rising to $5.7 trillion in 2024 (see Figure 2), though this still represents a small portion of global payments. For example, as a percentage of cashless payments in the U.S., stablecoin transactions remain below four percent.

Figure 2: Stablecoin transactions

Tokenized Deposits

With interest in retail CBDCs limited thus far, and the public sector’s concerns about the viability of stablecoins (which remain unregulated in many jurisdictions), the digital asset industry has also begun exploring other options. Specifically, the digital representation (or tokenization) of commercial bank deposits utilizing DLT—also referred to as tokenized deposits—has gained increased attention, though it remains largely experimental at the moment.

Commercial banks and international organizations, including the Bank for International Settlements (BIS) and the Institute for International Finance (IIF), are particularly interested in how tokenized deposits can benefit the recent trend toward the tokenization of financial instruments. For example, Project Agorá—a collaboration between the BIS, IIF, seven central banks, and 41 private sector institutions—aims to better understand the role of wholesale tokenized central bank money and tokenized commercial bank deposits to enhance cross-border payments. Other notable examples of public-private partnerships exploring tokenized deposits include:

- Regulated Liability Network (RLN), bringing together the Bank of England, Financial Conduct Authority, and numerous financial industry partners in the UK to explore the value of tokenized deposits and assess the potential benefits including reduced fraud and increased efficiency.

- Project Guardian, a collaborative initiative between policy makers and financial industry participants, implemented by the Monetary Authority of Singapore, to study the potential financial market efficiencies and enhancements to liquidity from asset tokenization.

- Regulated Settlement Network (RSN), a proof of concept evolved from the RLN and coordinated by the Securities Industry and Financial Market Association (SIFMA) in the U.S., exploring the use of tokenized deposits and U.S. Treasury securities for ledger-based digital settlement.

Despite this activity, few instances of live tokenized deposit implementations exist – and publicly available data for these initiatives remain limited. J. P. Morgan’s Kinexys Digital Payments platform (formerly Onyx) is a well-known example that has been live for more than 4 years, but the only data currently available are headline transaction volumes totaling more than $1.5 trillion over that span. More recently, Citi announced in October 2024 that it had moved its Citi Token Services initiative from a pilot to a live commercial platform, though transaction data on this program remains unavailable.

Recent estimates from McKinsey suggest that the potential value of tokenized assets could reach nearly $2 trillion by 2030. Although this forecast does not include tokenized deposits and focuses instead on assets such as bonds, equities, loans, and precious metals, it should be noted that the exclusion of tokenized deposits was done to avoid potential double counting, as the report states that tokenized deposits will ultimately be used in the settlement of other tokenized assets.