For as long as credit and debit cards have existed, there have been certain unwritten rules.

Prime among them? One card, one funding source.

For each line of credit, checking account or prepaid balance at your disposal, you need a separate card. This means a lot of us, for a long time, have carried around a small stack of plastic.

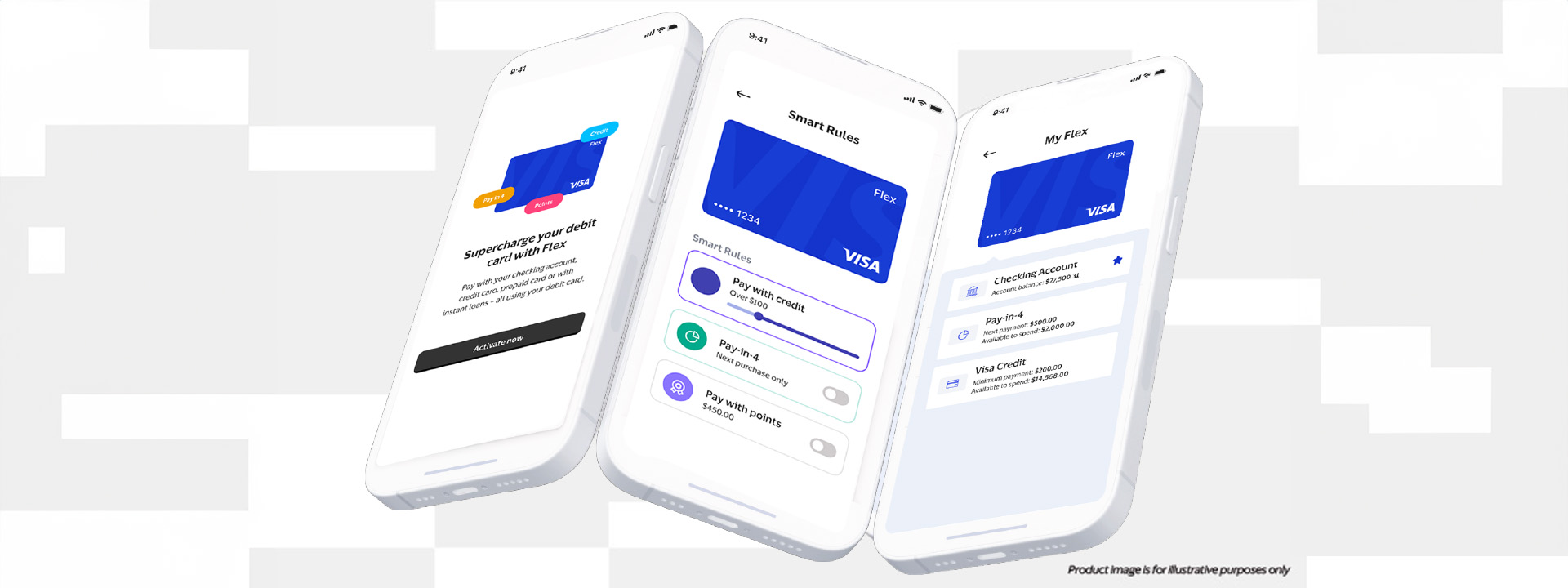

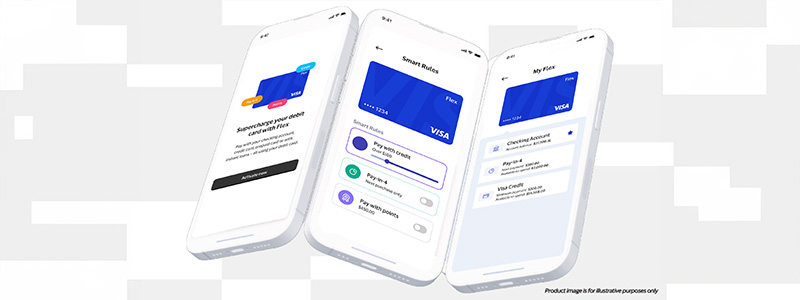

In the not-too-distant future? Wallets are in for a slimdown. New, flexible credentials map multiple funding sources to a single card — virtual or otherwise.

The payment credential of the future is what you need it to be when you need it.

Picture this:

You’re at the checkout and your account balance isn’t quite what it needs to be. But your loyalty points and line of credit are both healthy.

Instead of leaving items on the belt, you open your issuer’s mobile app and swap funding sources, turning what was your “debit card” into a credential that can draw on another available balance — all before your groceries are even halfway bagged.

Visa Flexible Credential — a new technology that lets issuers give their clients the ability to access different funding sources on an existing payment card — is already letting consumers do exactly that.

From line of credit or checking account, to loyalty points, prepaid debit or installments, some shoppers — and in the near future, all shoppers whose issuers enable the technology — are living in the future of payments, where one card can tap into different types of funding sources.

The future is here, but it’s not yet everywhere.

On the back end, Visa’s existing acceptance infrastructure makes the Flexible Credential possible, capturing and routing transactions based on a customer’s selected preferences.

In pilot markets, it’s already up and running, with some $3 billion in transactions processed through the Visa Flexible Credential Pilot.

One Visa study found that 51% of card users want the power to access multiple accounts and funding sources through a single credential.¹ While that flexible future is here, it’s not yet everywhere. But it’s coming — and soon. Region by region, issuer by issuer, shoppers and FIs will begin to see this capability more and more, with a U.S. pilot coming later in 2024.

- Source: from Visa Flex Account Consumer Research Conducted November 2022: Consumer evaluation of Flex Consumer Value Proposition to support Visa’s pitch to Issuers (AP Markets only)