Consumers expect their money to move as fast as everything else in life – from meals to messages to rides. Whether sending funds to family or splitting a bill with friends, the experience needs to be fast, secure, and integrated into everyday experiences.

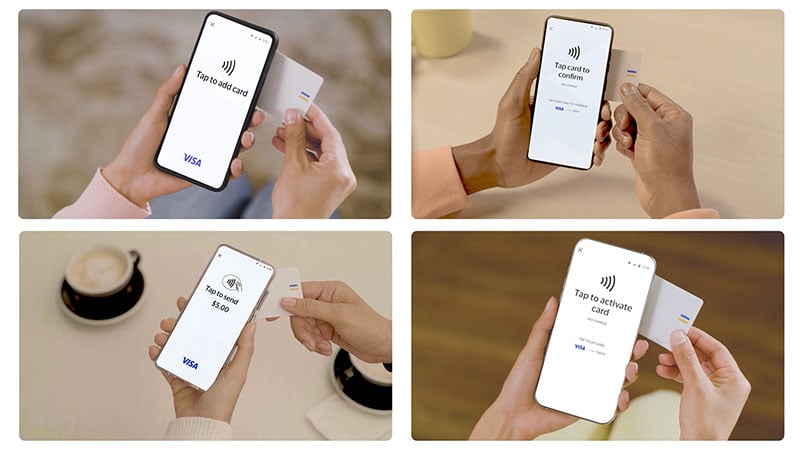

To help simplify P2P payments, Visa has collaborated with Samsung to introduce the first-ever Tap to Transfer¹ feature for Samsung Wallet in the U.S., powered by Visa’s Tap technology and enabled by the Visa Direct real-time² solution platform.

With this launch, Samsung becomes the first Visa partner to bring Visa’s Tap to P2P (peer-to-peer) payments to life. Tap to Transfer allows Samsung Galaxy users to send money to the bank accounts of friends or family simply by tapping their phones together or by tapping a friend’s participating contactless debit card, regardless of the receiver’s device or digital wallet. This means no app navigation, no manual entry of card details, no wait times, and no more hassle if a friend doesn’t have the same P2P app.

Samsung Tap to Transfer creates interoperability between digital wallets, allowing Samsung users to transfer funds to friends or family across wallets within a minute.²

Built on Visa’s Tap technology

“This innovation is powered by Visa’s Tap technology, which allows consumers to tap their card on NFC-enabled consumer devices, unlocking a number of new Tap innovations from Visa,” said Geraldine Mitchley, VP, Head of Visa Tap Global Enablement, Visa.

Use cases built on Visa’s Tap technology include Tap to Phone which has recently seen a surge in global adoption. Now, we’re expanding that same contactless technology to support Tap within new consumer use cases like Tap to P2P.

Samsung, is the first to go live with Tap to Send, setting the stage for a new era of tap-based P2P payments. It’s a powerful example of how Visa is partnering with global innovators to redefine how money moves — putting the speed, security, and reach of Visa Direct and Visa Tap products into the palm of your hand.

Fast, familiar, and frictionless

More than ever, consumers want to manage their money with the same simplicity they use to request a rideshare, order food delivery or share photos with friends and family. Tap to Transfer delivers just that: a fast, secure, contactless way to move money quickly and directly from a Samsung Wallet to a friend’s bank account via their debit card – with just a tap.

Behind the scenes, Visa Direct helps facilitate the movement of these funds quickly and securely to the recipient’s bank account in real-time²—helping users send money with ease.

“This literally puts the power of money movement in the hands of consumers. Send money to a bank account within a minute with a simple tap between phones,” said Jim Filice, VP, Head of NA Money Movement, Visa. “Under the hood, Visa Direct’s real-time payments helps facilitate the movement of funds, bringing speed, security, convenience and scale to Tap to Transfer.”

Whether it’s splitting dinner, paying a roommate, or covering a shared expense with a family member, Tap to Transfer makes P2P payments quick and secure with just a tap.

- Requires a contactless and payments transaction-enabled Visa debit card from a participating U.S. bank. Fees and limits apply. Your financial institution or mobile carrier may charge you. See Samsung.com for details.

- Actual fund availability for all Visa Direct transactions may depend on receiving financial institution, account type, region, compliance processes, along with other factors, as applicable.