Smarter, faster, more digital: The global shift in holiday spending

From AI that powers smarter gift giving and prevents fraud to stablecoins gaining traction across emerging markets, Visa’s latest research shows a worldwide move toward more intelligent, secure and seamless holiday payments.

Imagine this holiday future: AI curates the perfect gift at the perfect price for you; facial recognition verifies your purchase in a blink, and unwrapping crypto under the tree? Totally normal. That future isn’t far off as consumers around the world warm up to these new technologies, according to new research conducted by Morning Consult on behalf of Visa.

A new global spending landscape

As consumers worldwide prepare for the 2025 holiday season, a new global study shows just how dramatically shopping behaviors are evolving across markets. The findings, drawn from 12 countries, present a clear shift: Consumers around the world are embracing new technologies.

Across all markets, AI, digital currencies and digital wallets are becoming entrenched in global holiday spending behavior. While convenience and security remain baseline expectations for payments, fraud concerns are still top of mind, heightening the need for continued education and a secure, trustworthy infrastructure. And Gen Z’s preferences are becoming the blueprint for the future of commerce.

AI shopping goes mainstream

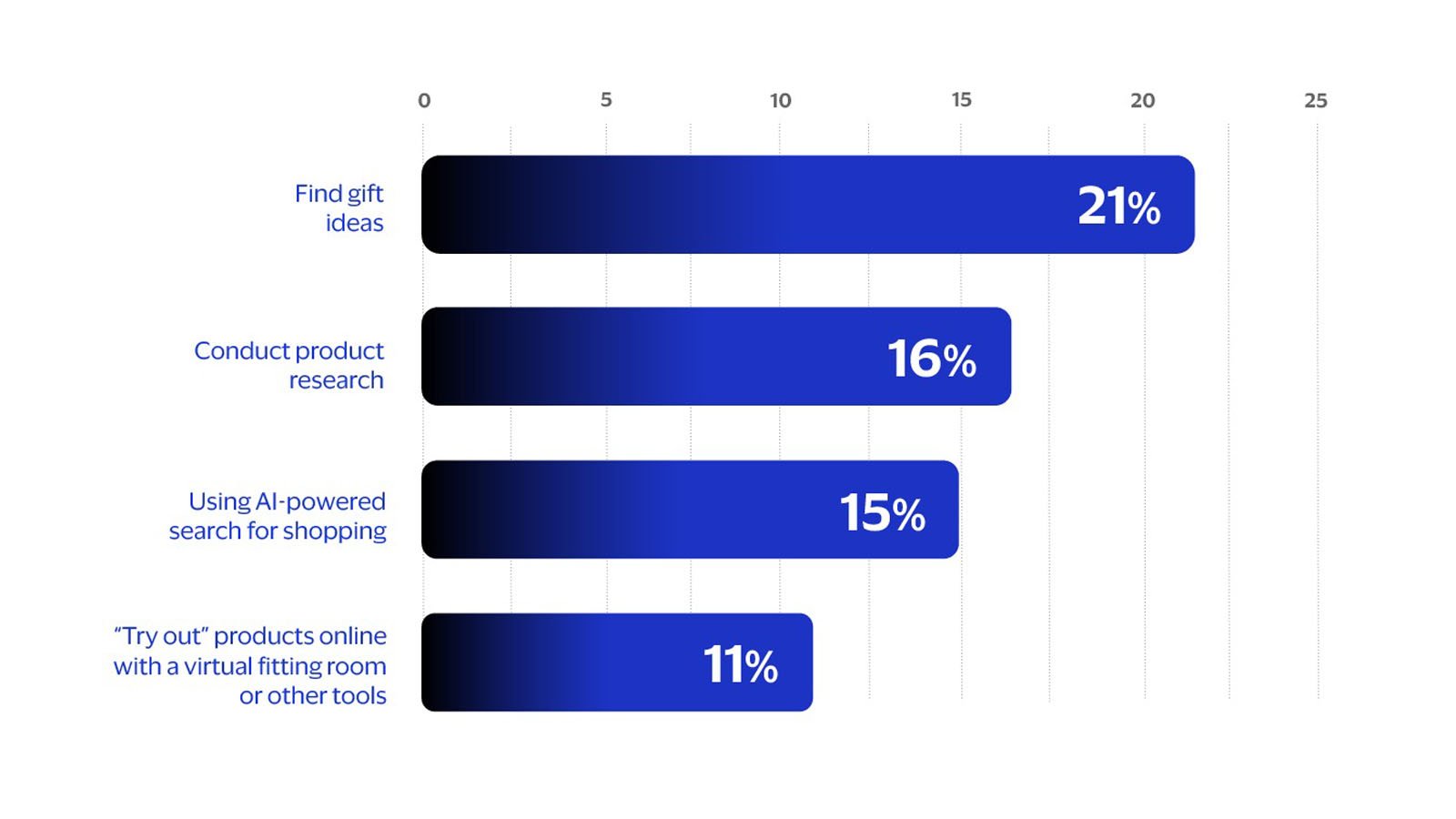

Across markets, AI is becoming a trusted holiday companion, especially among deal-driven consumers:

Spain, Singapore, South Africa, the UAE, Brazil and Mexico show the highest rate of AI openness.

In the U.S., nearly half of consumers (47 percent) have already used AI for at least one shopping-related task, with gift discovery, price comparison and product research emerging as top holiday use cases across North America. This data signals the beginning of an agentic AI era where shoppers rely on intelligent tools not just to browse, but to make decisions too.

Crypto and stablecoins step into the holiday spotlight

Across markets, digital currencies are shifting from niche to normal, especially for younger generations.

Nearly half (45 percent) of Gen Z in the U.S. would be excited to receive cryptocurrency, nearly double the rate of all Americans, at 28 percent.

Stablecoins are gaining traction too: 41 percent of U.S. remittance users say they’re likely to use stablecoins for international money transfers in the future.

Globally, this openness to digital currencies is far from uniform. Brazil (65 percent), Mexico (62 percent), South Africa (57 percent) and the UAE (66 percent) remittance users show the strongest willingness to adopt stablecoins in the future. UK consumers are warming to stablecoins (36 percent), while Germany remains cautious (23 percent).

More shoppers are reaching for digital wallets this holiday

Digital wallets are gaining global dominance, especially among younger generations. In the U.S., one in five shoppers already prefer digital wallets, and Gen Z is driving the shift. They are just as likely to use a digital wallet as a physical card (36 percent vs. 34 percent).

Worldwide, digital wallet adoption patterns reveal striking contrasts across regions:

Singapore and the UAE lead the world, where digital wallets outperform cards and cash on trust, security, speed and convenience.

Brazil shows a strong preference for digital wallets, driven by acceptance, speed and perceived fraud protection.

Germany remains a cash stronghold, a sharp departure from the UK, which leads other EU markets in digital wallet experience.

Even in markets where cash remains culturally important, consumers expect future decline. Across Europe, many anticipate that cash usage will fall over the next decade, underscoring a broader, steady movement toward digital payments.

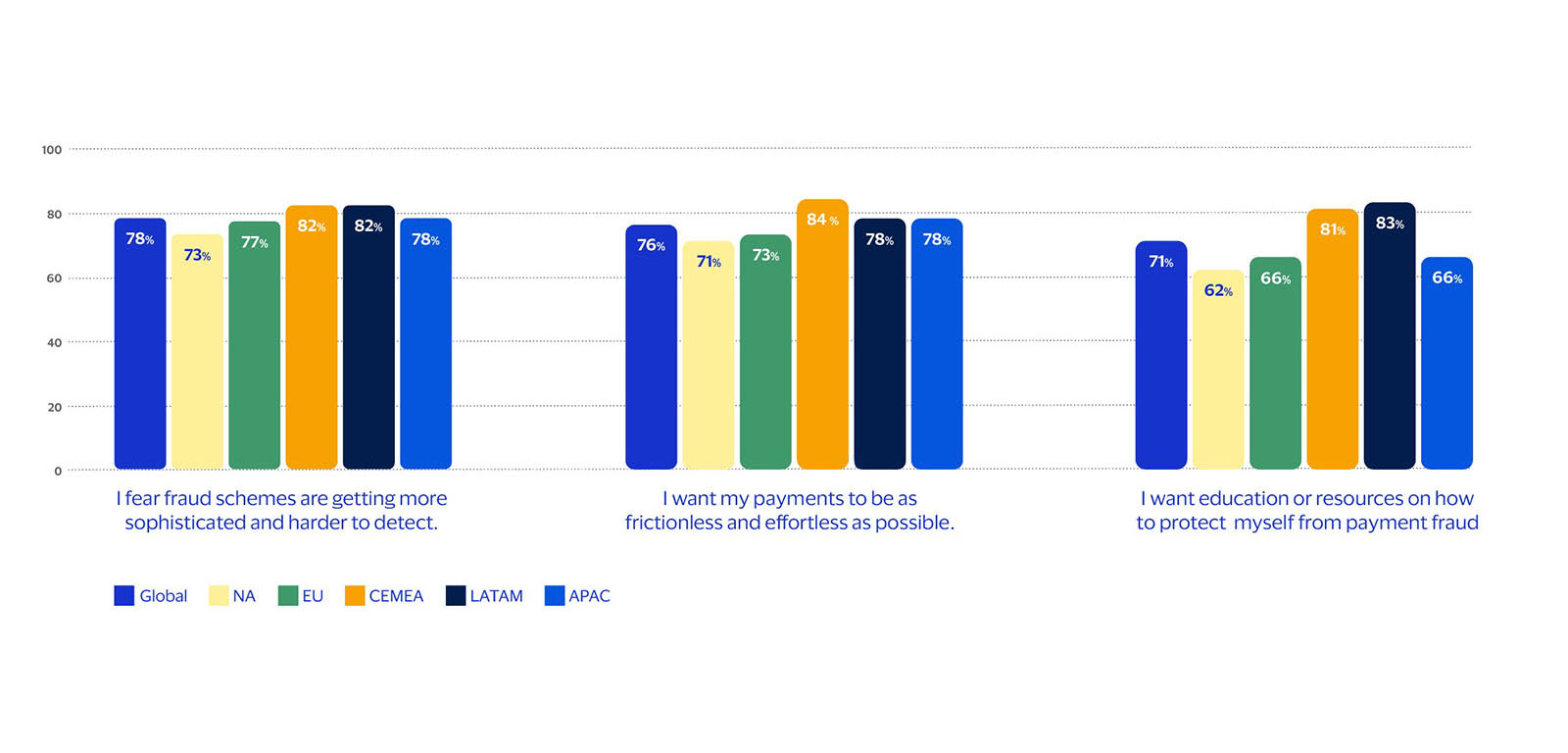

Security and trust shape holiday shopping decisions

Security is the single biggest factor influencing payment choice globally, with 79 percent of respondents saying it is extremely important. Consumers want frictionless payments yet they fear that fraud schemes are becoming too sophisticated. U.S. consumers are particularly concerned this season:

66 percent worry that friends or family may fall for an online scam

82 percent have taken proactive steps to protect themselves through two-factor authentication, frequent password changes and other measures

Gen Z is redefining how the world shops

If there is one generational force emerging from the study, it’s Gen Z. Gen Z’s near-parity preference between digital wallets and physical cards signals a fundamental shift that will influence acceptance, payment innovation and consumer expectations for years to come.

They’re also normalizing digital gifts like crypto and making cross-border purchases through social platforms, accelerating the move toward a digitally native way of giving. Globally, 60 percent of Gen Z shoppers are buying gifts from overseas retailers this season.

Gen Z’s influence extends into travel as well. Worldwide, 41 percent of Gen Z consumers plan to travel more this holiday season than last year, signaling renewed confidence and prioritizing experiences like gig-tripping.

Survey Methodology

This survey was conducted in partnership with Morning Consult between October 14 to October 16, 2025, among a sample of 1,000 adults in 12 markets: U.S., Canada, Mexico, Brazil, France, Germany, Spain, the UK, Australia, the UAE, Singapore, and South Africa. The interviews were conducted online, and the data were weighted based on gender, education attainment, age, and race. Results from the full survey have a margin of error of plus or minus 1 percentage point.