In stablecoin data, there is a lot of noise.

Stablecoins, compared to other payment and settlement networks, are unique because they are issued and transferred over public blockchains, and transaction data is publicly available in real time.

However, accessing and organizing this data requires blockchain knowledge and expertise. This can be challenging, particularly when stablecoins are used across many different blockchains that each have their own nuances.

There is also a lot of noise in this data given that blockchains are general purpose networks where stablecoins can be used across a range of use cases with transactions that can be initiated manually by an end user or programmatically through bots.

For instance, developers can create automated bot programs that perform activities like stablecoin arbitrage, liquidity provision, and market making. These activities are vital for sustaining the growing decentralized finance (defi) ecosystem. However, the onchain transactions resulting from interactions with these automated programs don't resemble settlement in the traditional sense.

We think this programmability of transactions that blockchains enable is unique, however it’s hard to compare these transactions to the kind of organic payments activity that is more likely initiated by a consumer or business.

So, what does the data actually say, clearly and plainly?

Why the Visa Onchain Analytics Dashboard?

Launched in 2024, the Visa Onchain Analytics Dashboard aims to address this key question. We partnered with the blockchain data provider Allium Labs to create a dashboard that is designed to be an easily-digestible, freely-available window into publicly-available aggregated blockchain data, beginning with stablecoins. From information on active users, to volumes by coin and blockchain, to transaction sizes and a continuously evolving set of stablecoin metrics, the Visa Onchain Analytics Dashboard looks to provide clear insights into stablecoin activity — insights that enable anyone interested in the stablecoin ecosystem to easily access and follow.

Looking at the data, we’ve found four notable trends relating to the current state and potential of stablecoins:

- Stablecoin supply is approaching all-time highs. Total demand for stablecoins has picked back up in 2025, with circulating supply approaching $250 billion, up nearly $100 billion from 2024.

- Steady growth of monthly active stablecoin users. We are seeing growth in regular users of stablecoins, with 47 million monthly active users across all chains.¹

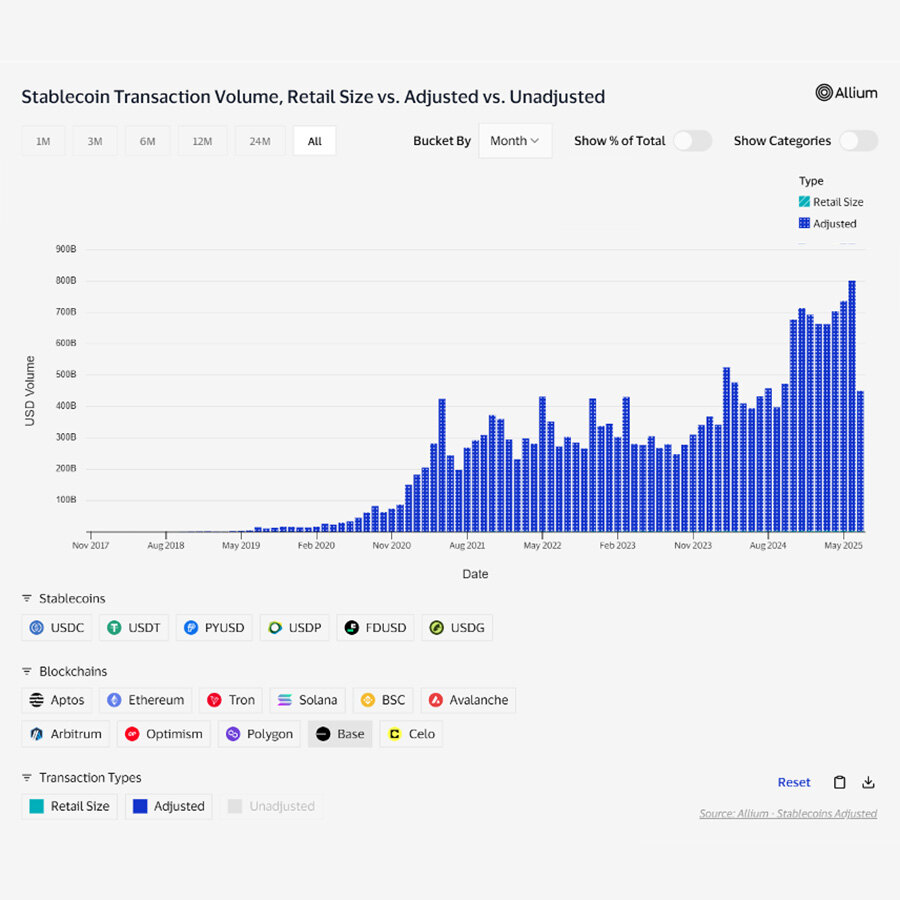

- Discrepancy between total transfer volume vs. bot-adjusted transfer volume. When we apply a simple heuristic that removes inorganic data, we see that transaction volume for the last 30 days can be adjusted from $3.9 trillion to $817.5 billion

Tracking retail-sized transactions on the dashboard

Retail-sized transactions capture a small slice of stablecoin activity, representing less than one percent of all adjusted stablecoin volume in the past 12 months (through March 2025). Most stablecoin volume still comes from high-value transfers, not retail transactions.

While the data may show it’s still early days for retail use there are still other use cases, Visa has partnered with leading wallets and fintechs to issue stablecoin-linked cards, making it possible to use stablecoins for everyday purchases at Visa-accepting merchants — from your morning coffee to a weekend getaway. Visa is focused on becoming a network enabling consumers to make use of their stablecoins as part of their everyday purchasing, playing a key role in enabling how stablecoins can be spent.

Visa has been at the forefront of digital payments for nearly sixty years, studying value transfer and application of financial data. We have deep expertise and history around the myriad of ways consumers and businesses use payment products. And we make it our business to understand deeply any new technologies that can facilitate money movement as they emerge.

Since launching this tool, we’ve made adjustments and additions designed to ensure we’re capturing what’s happening in the stablecoin landscape. We also welcome a conversation — around what’s here and what’s not, and what could make this tool better. What are the best methodologies for adjusted volume to understand organic activity? What metrics are important for your particular segment? What could be more clear or more focused?

Case studies, comparisons, statistics, research and recommendations are provided “AS IS” and intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice. Visa Inc. neither makes any warranty or representation as to the completeness or accuracy of the information presented, nor assumes any liability or responsibility that may result from reliance on such information. The information contained herein is not intended as investment or legal advice, and readers are encouraged to seek the advice of a competent professional where such advice is required.

¹As of 4/24/24