A fraudster using a laptop while holding a credit card

From old-school fraud to digital scams, there are a number of ways fraudsters are finding their way into consumer pockets. In the latest edition of the global report, State of Scams: Fall 2024 Biannual Threats Report, Visa identifies emerging threats and scams targeting banks and consumers.

Old-school fraud is back

With the rise of sophisticated social engineering and digital identity scams, network security has become a priority for those in charge of protecting customer data. Visa alone has invested $11 billion over the last five years in technology and innovation to protect its global payments network. However, the global report found that fraudsters are now reverting to old-school methods like stealing physical cards to purchase items for resale, buy gift cards or use the card number to shop online or transfer money.

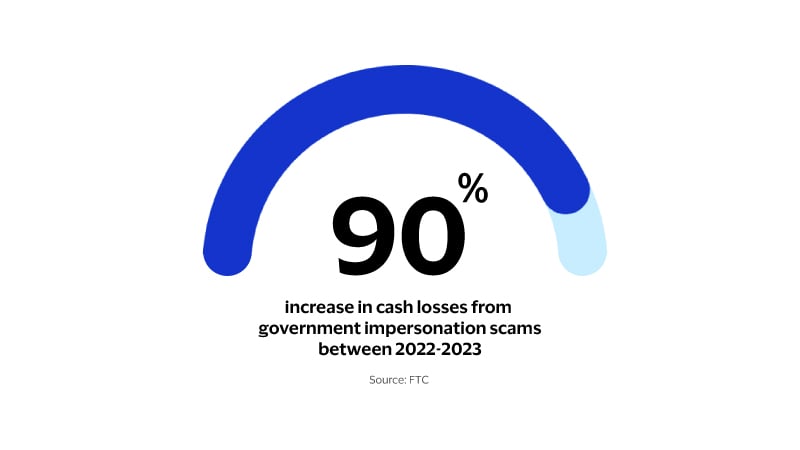

Impersonation scams surge

Fraudsters posing as government representatives are succeeding in exploiting unsuspecting victims and stealing their personal information and money. In the first three months of 2024, the average government impersonation scam victim in the U.S. lost $14,000 in cash, totaling more than $20 million. Cash losses from government impersonation scams increased 90 percent, in fact, between 2022 and 2023. Visa predicts that banks will see an increase in large ATM withdrawals due to fraud as government impersonation scams continue to rise.

Detecting the digital pickpocket

Since digital pickpocketing occurs via a physical tap, the dynamic data from the transaction is accurate, making it harder to identify fraud in real-time. In 2023, the Visa team identified a pattern of elevated authorization scores. They learned that the fraudulent merchants are often registered to an international location, outside the country where the digital pickpocket stole the information.

How to protect yourself

Stay alert in crowded places and be aware of your surroundings. If your personal or payment account information has been compromised, make sure to:

- Monitor your transactions and report any suspicious activity as quickly as possible to your financial institution.

- Update your passwords, choosing a strong and unique one for every account. When usernames and passwords are compromised, criminals can try to re-use that information at various sites beyond the breached one.

- Make sure to enable two-factor authentication wherever possible for added protection.

- Remember to never share sensitive information via call, text, mail or social media.

With the holidays around the corner, make sure to know the warning signs of a phishing scam too. Be wary of too-good-to-be-true deals from recognized brands or fake emails that direct you to unknown URLs. Here are more ways to shop safely online and avoid phishing scams to protect your accounts online and off.

How Visa protects you

Visa’s global security network takes a multi-layered approach to fraud detection to help identify and prevent fraud before it happens. Even as we have seen increases in data breaches, Visa has kept fraud rates at less than one-tenth of one percent for more than a decade. Online or offline, we take proactive steps to make sure your information and transactions are secure, and with our Zero Liability policy*, you’re covered if your card is ever lost, stolen or fraudulently used.