-

Enabling the commerce ecosystem

Give customers more flexibility to pay for things they want now, or over time. Visa’s BNPL solutions (Buy Now, Pay Later) help businesses and financial institutions account for payment options that customers expect.

Why Visa for your BNPL solutions

Our portfolio of BNPL solutions can help you reach your growth goals and connect more with your customers.

Meet customer expectations

We deliver BNPL solutions that give your customers the flexibility to get the things they want now and pay for it over time.

BNPL powers growth

Adopting BNPL offerings is easy and helps you meet the growing demand for added payment flexibility and control.

Our portfolio of BNPL solutions helps enable businesses and financial institutions

We help drive efficiencies with a set of full service offerings across purchases, repayments and settlement flows.

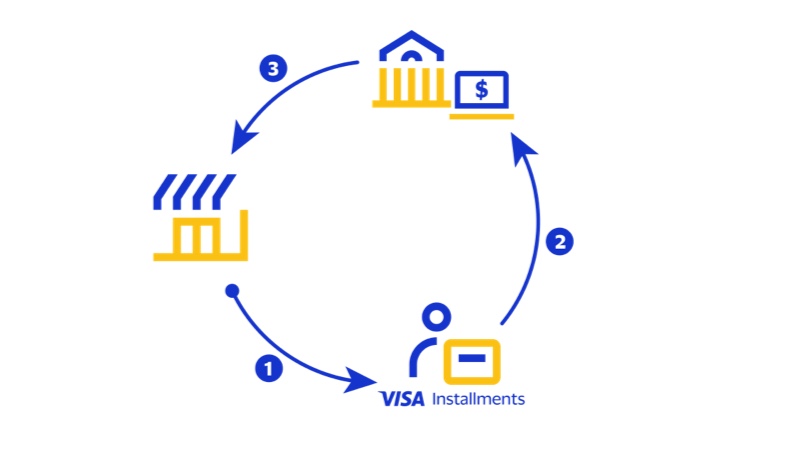

- Cardholder uses Visa Installment Solutions (VIS) at checkout or Visa Installment Credential to make purchases in agreed upon payment schedule.

- Cardholder repays their installments plans using their existing Visa card.

- Financial institution uses Visa rails for efficient B2B Settlement with Merchants.

Get the facts about BNPL

Learn how we can help you deliver BNPL solutions to your customers.

Our growing portfolio of BNPL solutions

Learn how BNPL payment options can help you with your business goals and priorities.

Provide payment flexibility with Visa Installment Solutions

Using the trusted Visa network, Installment Solutions help drive growth for our partners and clients through a set of APIs, or on existing standards such as ISO.

Visa Installment Credential works anywhere Visa is accepted

Visa Installment Credential helps financial institutions develop BNPL credentials that can be used anywhere Visa is accepted without merchant integration.