B2B suppliers around the globe are eager to find new ways to gain a competitive advantage and propel business growth. However, there’s one solution they may not have considered to help them run their businesses more profitably and build stronger customer relationships: Accepting commercial cards for B2B payments.

Today, many suppliers continue to rely on traditional payment methods like checks, account-to-account payments or wire transfers. These payment methods come with significant administrative overhead, can be prone to fraud and can tie up working capital. Most importantly, they’re not equipped to keep pace with customer expectations or the speed of modern commerce.

There are several reasons B2B suppliers may not have considered commercial card acceptance as a payment option to help them overcome some of their pain points. They may perceive that merchant fees are too high for large commercial card transactions — or they may think that the process of switching to cards is too complex.

It’s time to challenge these perceptions so that B2B suppliers can expect more with commercial card acceptance. By accepting commercial cards, the benefits consistently outweigh the costs and can help suppliers unlock new value.

Four core benefits of commercial card acceptance

To illustrate how commercial card acceptance can benefit suppliers around the world, Visa commissioned a series of research studies across five regions that explore the challenges and opportunities of accepting commercial cards.

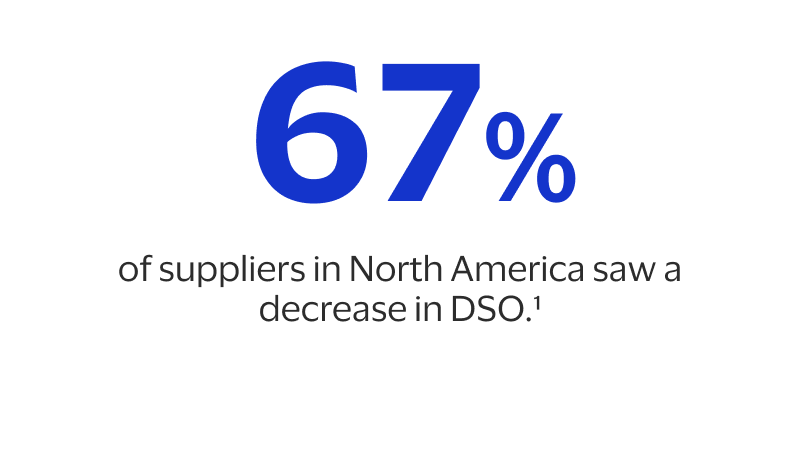

Our research identified four core benefits of commercial card acceptance: increased gross revenue, reduced financial losses from bad debt and fraud, faster access to working capital through reduced days sales outstanding (DSO) and improved operational efficiencies. Below, we explore each of these benefits and share important insights across each region. Overall, we found that modernizing payments with commercial card acceptance can turn a cost center into a growth driver. In addition, while commercial card acceptance rates vary broadly between regions — from 25%-80% — regions with higher acceptance rates show stronger return on investment (ROI).

Suppliers who accept cards can expect to streamline payment receipt, drive revenue gains and accelerate growth.

They’re also equipped to meet changing customer expectations, as well as the desire to leverage commercial cards to pay for business transactions. The ability to accept commercial card payments provides added convenience for customers, which deepens relationships and can help power business growth.

Research from various regions documented the impact:

- In North America (NA), respondents reported a 132% return on investment for commercial card acceptance over 3 years.¹

- For Central Europe, the Middle East and Africa (CEMEA) and Asia Pacific (AP), 76%² and 50%³ of card acceptors, respectively, reported that card acceptance drove an increase in sales.

- Further, 76% of suppliers in Visa-commissioned Latin America and the Caribbean (LAC) research perceived an increase in incremental revenue with commercial card acceptance.⁴ In addition, suppliers in the region indicated that they would expect to lose 21% of business if they stop accepting cards.⁴

- In Europe, 54% of card-accepting suppliers indicated that they saw an increase in sales — reporting an average uplift of 667 basis points, while the overall average increase stood at 359 basis points across all suppliers.⁵ And European respondents said that nearly half (47%) of all carded sales are net new sales.⁵

Commercial card acceptance may be the advantage suppliers never knew they needed

Want to learn more?

To learn more, download our regional white papers: Understanding the impact of commercial card acceptance across the globe.

- The Total Economic Impact of Commercial Credit Card Acceptance: An Update, Forrester Consulting. Originally published March 2021, updated June 2024. The referenced study was conducted in the U.S. and actual results may vary by merchant.

- Research was commissioned by Visa and conducted by KoreFusion among 1,010 large CEMEA merchants between August and October 2024. The reported benefits are based on data from surveyed merchants at a specific point in time. The study did not collect information on the time required to realize these benefits. Results may vary for individual merchants.

- Research was commissioned by Visa and conducted by KoreFusion among 1,000 large AP merchants between August and October 2024. The reported benefits are based on data from surveyed merchants at a specific point in time. The study did not collect information on the time required to realize these benefits. Results may vary for individual merchants.

- Research was commissioned by Visa and conducted by RGX among 762 suppliers across nine Latin American and Caribbean markets between March and May 2024.

- Research was commissioned by Visa and conducted by KoreFusion among 850 large European merchants (>$50M USD turnover) between July and September 2024. The reported benefits are based on data from surveyed merchants at a specific point in time. The study did not collect information on the time required to realize these benefits. Results may vary for individual merchants.