Streamline your business operations with stablecoins

Stablecoins represent a strategic opportunity for banks and fintechs to enable a fiat-denominated store of value and more efficient cross-border money movement into and out of emerging markets.

Create your stablecoin strategy with Visa

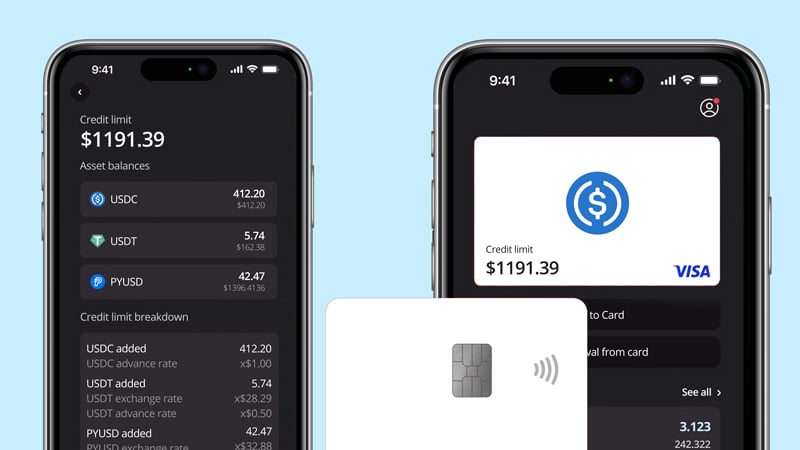

Partner with Visa to help integrate stablecoins into your strategy. You can utilize stablecoins to enhance your digital wallets and payment features, and offer stablecoin-linked cards that enable your customers to make purchases with stablecoins across the vast Visa merchant network.

As investment into stablecoins takes off, there are more use cases for banks and crypto wallets

Stablecoins are becoming increasingly integrated into mainstream payments — not just for crypto companies, but for banks, corporates and financial institutions globally. As adoption becomes more widespread, every financial institution should have a stablecoin strategy — Visa can help.

White paper: Stablecoins and the future of onchain finance

As recent shifts in the regulatory landscape have the capacity to catalyze stablecoin growth, every bank and fintech should have a stablecoin strategy. Explore how stablecoins are integrating into traditional payment solutions while enabling banks to accelerate growth across public blockchains.

Leveraging stablecoins to help improve the customer experience

Stablecoins enable banks to offer a fast and cost-effective alternative to wire transfers in emerging markets. Their always-on infrastructure is a big advantage for financial institutions as they strive to grow their customer base and improve the experience they provide to their business clients and consumers.

Remittances

Consumers can use digital wallets to make payments in emerging markets.

Business payouts

Businesses can make cross-border payouts to creators, contractors and freelancers and take advantage of a fast, cost-effective way to pay suppliers.

Dollar store of value

Consumers and businesses can use stablecoins to store value in more stable assets.

Tokenized assets

Stablecoins enable banks to replace manual systems with smart contracts so they can offer next-generation financial solutions.

Visa partners

Reach out to Visa to get connected with our partners.

Thought leadership

Explore perspectives on blockchain technology, crypto-based payment innovations and relevant use cases across the financial ecosystem.

Stablecoins, tokenized assets and onchain finance

Dive into the Tokenized podcast and newsletter for expert perspectives on finance, payments and blockchain — including insights from Cuy Sheffield, head of crypto at Visa.

*Stablecoins are digital currencies transacted on blockchain networks and designed to maintain a stable value by being pegged to a reserve asset such as fiat currency.

- Visa. April 17, 2025. Visa Onchain Analytics Dashboard. Data provided by Allium Labs.

- Visa. September 30, 2024. Visa Fact Sheet.