Stablecoin data and trends

It’s important for banks to ground their understanding of stablecoins and the potential implications in data. For every stablecoin transaction, there is a visible data trail on the public blockchains it was transferred over. A single stablecoin can be issued and transferred over a dozen blockchains. Therefore, cross-chain differences and noise in the data can make insights challenging to interpret. This complexity has historically hindered banks and regulators from effectively understanding stablecoin activity.

To address this challenge, Visa partnered with blockchain data provider Allium Labs to create the Visa Onchain Analytics Dashboard — a free, user-friendly tool that provides insights into stablecoin growth and activity.

The Visa Onchain Analytics Dashboard gives anyone interested in fiat-backed stablecoins more insight into the evolving stablecoin landscape. The dashboard tracks stablecoin movements across 10 major blockchains to highlight trends related to supply and transaction volume and to also address activity. Where Visa banking clients need additional support, Visa Consulting and Analytics also offers to curate the data as a service and produce actionable insights on the latest stablecoin trends.

A new regulatory environment

Recent regulatory advances for stablecoins

-

-

Executive order

In January of 2025, President Trump signed an executive order titled “Strengthening American Leadership in Digital Financial Technology,” with the purpose of establishing a regulatory framework for digital assets, including stablecoins— as well as promoting “dollar sovereignty through stablecoins.” This executive order established a working group on digital assets markets chaired by AI and crypto czar David Sacks, and it will submit regulatory and legislative proposals within 180 days.

Rescinding of SAB 121

The Securities and Exchange Commission (SEC) issued a new staff accounting bulletin that rescinded SAB 121, which treated crypto assets and stablecoins that a bank custodies on behalf of customers as liabilities on the bank’s balance sheet, removing what had been a significant barrier to banks’ participation in the ecosystem.

Bipartisan stablecoin bills

Bipartisan bills designed to establish a clear regulatory framework for stablecoin issuance by both banks and non-bank entities have been drafted. Representative Steil’s STABLE Act has passed the House Financial Services Committee, and Senator Hagerty’s GENIUS Act has passed the Senate Banking Committee, both with bipartisan votes.

New banking regulator guidance

The Office of the Comptroller of the Currency (OCC), Federal Deposit Insurance Corporation (FDIC) and Federal Reserve Board rescinded guidance requiring their supervised banks to notify their regulator or obtain non-objection prior to engaging in crypto-related activities. They clarified that crypto-related activities are permissible for the banks that they supervise.

-

-

Japan

In 2022, the Japanese parliament passed a bill recognizing stablecoins as a form of digital money that can be issued by licensed banks, trust companies and money transfer agents.

Singapore

In 2023, the Monetary Authority of Singapore (MAS) offered regulatory clarity for banks and non-banks issuing single currency stablecoins pegged to the Singapore Dollar (SGD) — or any of the top ten global currencies — as “digital payments tokens.”

Europe

In 2024, Europe became the first major market to establish a comprehensive framework for stablecoins with their Market in Crypto Assets (MiCA) regulation, which classifies stablecoins as “e-money tokens” with rules governing their issuance and consumer protection.

Hong Kong

In December of 2024, the Hong Kong Monetary Authority (HKMA) released a draft of their proposed stablecoin regulatory framework, which enables licensed issuance of Hong Kong Dollar (HKD) and non-HKD fiat backed stablecoins.

As regulatory clarity continues to emerge globally, Visa expects an increase in stablecoin adoption by traditional financial institutions that will open the door for stablecoins to play a more meaningful role in the interconnected global economy.

Stablecoin use cases and opportunities for banks

Stablecoins emerged as a utility for crypto capital markets, where traders used stablecoins to efficiently move value between crypto assets and dollars across global exchanges without the need to on/off-ramp between blockchains and fiat currencies. However, in recent years, emerging fintechs and PSPs have increasingly used stablecoins as a stable, dollar-denominated store of value, as infrastructure for cross-border money movement and as a platform for developing programmable financial products through smart contract integration.

While many banks and financial institutions have largely chosen to remain on the sidelines during these developments, emerging financial use cases for stablecoins present significant opportunities for banks and financial institutions to enhance their existing operations and service offerings. This can then help them improve efficiency, reduce costs and develop new offerings for their clients.

As stablecoin adoption rises, so do opportunities

-

-

Overview

Approximately 1.4B people reside in countries where inflation surpasses 10%,⁴ a factor that creates significant economic challenges for their populations. In these regions, demand for USD accounts is strong, but economic instability and trade deficits force banks to prioritize their scarce dollar reserves for critical imports, limiting access for individuals and businesses. Consequently, demand for dollars far exceeds the available supply. USD-pegged stablecoins have emerged as a practical alternative in these high-inflation environments.

Current traction

In high-inflation, emerging markets where access to dollar-denominated accounts is limited, stablecoin wallets have surged as a reliable substitute. For example, in sub-Saharan Africa, mobile applications like Opera’s Mini Pay enable consumers across the region to convert local currency into stablecoins and withdraw to local currency as needed. Similarly, companies like Acctual are providing corporates with access to dollar accounts and the ability to make cross-border invoices and payments.

Although stablecoins have been a useful tool for wealth preservation, their limited acceptance among merchants has limited their practical, day-to-day use. Visa has worked to address this limitation by being a leader in the development of stablecoin-linked cards. These cards allow consumers and corporates to link a Visa credential to their digital wallet and spend their stablecoins at any of the 175+ million Visa-accepting merchant locations worldwide.⁵ When a Visa credential is attached to a stablecoin-linked Visa card, customers can begin spending stablecoins without needing to off-ramp their stablecoins to local fiat.

To help streamline stablecoin-linked cards for issuers, as part of a stablecoin settlement pilot, Visa facilitates direct settlement from select issuers in stablecoins, offering a seven-day-a-week settlement capability. This approach helps reduce operational friction for issuers.

Opportunity for banks

For banks in emerging markets, stablecoins are an opportunity to give their consumers access to dollar accounts and cards. This allows consumers and businesses to hold dollars digitally as a store of value, without the challenges of maintaining physical dollar reserves. By linking these accounts to Visa credentials, banks can enable customers to convert stablecoin balances into spendable funds at the 175+ million Visa-accepting merchant locations worldwide.

-

-

Overview

Global remittances surpass $944B annually, with $685B directed to low- and middle-income countries, often accounting for a significant portion of their gross domestic product (GDP).⁶ Yet traditional cross-border remittance methods into emerging markets are often expensive and slow. The World Bank reports an average cost of 6.4% to send $200 driven by multiple intermediaries and elevated foreign exchange (FX) fees in corridors with volatile currencies.⁷ Settlement through these legacy channels can also take multiple days.

Because stablecoins run over public blockchains, they benefit from 24/7 near-real-time settlement and have transaction fees as low as a cent on certain blockchains. Furthermore, stablecoins are a borderless network that only require a digital wallet, helping to remove geographical barriers and dependence on traditional financial infrastructure for usage.

Current traction

Fintechs are leveraging this infrastructure to build new, front-end remittance solutions on stablecoin rails. For example, Felix Pago facilitates U.S. outbound remittances to Latin American countries via a WhatsApp interface. Users fund transfers with cards, and funds are disbursed to recipients’ bank accounts. On the backend, Felix partners with Circle to mint USDC. Then Felix sends the USDC to Bitso, a stablecoin exchange in Latin America, which converts the stablecoins to local fiat and delivers the payment via domestic payment rails.

Self-custodial wallet technology has become a powerful enabler for fintech applications seeking to build borderless payment solutions. Sling Money exemplifies this innovation, providing users with a modern interface for sending remittances to more than 140 countries while leveraging stablecoins as the underlying infrastructure.

By empowering users to control their own cryptographic keys and integrating with locally licensed off-ramps, Sling’s architecture allows users to operate across multiple countries while maintaining self-custody. This allows Sling to deliver a global financial product designed to offer consumers fast and cost-effective money movement without the substantial regulatory and operational overhead typically associated with international expansion.

Opportunity for banks

By adopting stablecoin-powered remittance solutions, banks in emerging and developed markets can offer clients faster, and potentially more cost-effective, cross-border payments. By reducing the need for correspondent banking, stablecoins can enable direct transfers, lowering fees and accelerating settlement times.

-

-

Overview

The World Bank estimates that the number of freelance workers around the world ranges from 150M to 300M, with approximately 40% residing in low- to middle-income countries.⁸ Across the globe, workers are turning to digital channels to generate income and unlock economic opportunities. The explosive growth of this creator economy has heightened companies’ demand for efficient, scalable payout solutions of all transaction sizes and across multiple currencies worldwide.

This push for global access to work is hindered by the persistent challenges of cross-border payments, which can be slow and expensive due to process inefficiencies and steep FX fees. The need to reach diverse endpoints in various currencies can erode cost-effectiveness and complicate the netting process. While some PSPs aim to address these issues by prefunding bank accounts globally, their reliance on traditional payment infrastructure can limit their effectiveness — particularly in emerging markets, where freelancers are highly concentrated and foreign exchange rates are high.

Stablecoins present an alternative, offering rapid global payouts denominated in dollar value. This enables freelancers to receive payments in a stable, dollar-based asset with near-real-time settlement at minimal cost. For those preferring local currency, regional exchanges can provide competitive FX rates with equally rapid conversion.

Current traction

Stablecoins are already being used by global corporates to facilitate cost-effective disbursements into emerging markets. For example, Scale AI makes weekly payouts to thousands of global freelancers, performing image training validations by leveraging Bridge’s stablecoin orchestration platform. Scale AI transfers fiat in a lump sum to Bridge, which mints the fiat into stablecoins from Circle and disburses the payments directly to contractors into their stablecoin wallets. These contractors can then convert their stablecoins into local currency using an exchange.

Opportunity for banks

As banks increasingly cater to corporates with sophisticated global payout needs, integrating stablecoins as a direct disbursement method offers a substantial value proposition and an edge over some fintech competitors.

-

-

Overview

The dollar has established itself as the dominant global trade currency, with the Atlantic Council reporting that 54% of exports are invoiced in dollars and 88% of foreign exchange transactions are dollar-quoted.⁹ This dollar-centricity makes access to dollars essential for corporates worldwide to operate effectively. However, in emerging markets, obtaining dollars presents significant challenges. These markets are also typically coupled with restrictive capital controls, making the access for dollars especially challenging.

These challenges are particularly notable in regions like sub-Saharan Africa, where intra-continental payments are costly and time consuming due to poor liquidity between African currencies. Such transactions frequently require routing through U.S. banking intermediaries, adding time to settlement and intermediary fees. Compounding these issues, since 2011, there has been a 40% reduction in active correspondent banking relationships due to escalating compliance burdens associated with cross-border transactions.¹⁰

Beyond access challenges, businesses in developed markets seeking global expansion face significant repatriation hurdles. Companies operating in emerging markets that collect local currencies face balance sheet exposure to often volatile currencies and must partner with intermediaries who charge substantial fees for local collections. These businesses can experience multi-day delays and high FX costs to repatriate funds. For instance, companies collecting payments from Brazilian consumers must sometimes wait 5-8 days to repatriate funds back to the U.S., creating cash flow inefficiencies and currency exposure risks.

Current traction

Stablecoins are helping corporates around the globe solve these problems by providing a mechanism to swiftly convert devaluing local currencies into a stable dollar-denominated store of value that can be repatriated quickly.

Starlink exemplifies this approach, collecting payments in Nigerian Naira, then working with partners to convert funds into dollars and repatriate them to the U.S. on an hourly basis. This approach can minimize exposure to devaluing currencies and accelerate repatriation, significantly enhancing corporate efficiency. Similarly, Yellow Card collaborates with large corporations like Nigeria’s largest food producer to facilitate supplier payouts invoiced in dollars. Though the company faces dollar-sourcing challenges due to capital controls, Yellow Card enables efficient, dollar-based transactions with lower costs and faster settlement times.

Similarly, companies like BVNK and Conduit are enabling corporates in developed and emerging markets to make global payouts using stablecoins as the middle layer and utilizing their exchange and bank integrations to convert to local currencies and make last-mile payouts. By leveraging stablecoins, they are able to power near-real-time settlements at competitive prices.

Opportunity for banks

As banks strive to better serve their corporate clients, stablecoins represent a strategic opportunity to enable more efficient cross-border money movement and optimize corporate treasury operations. For example, banks in developed markets can help their corporates power faster repatriation out of emerging markets and facilitate more efficient money movement into emerging markets, which have presented challenges due to correspondent bank delays and fees. Banks in emerging markets can utilize stablecoins to access dollars more effectively and power supplier payments for their corporate customers.

-

-

Overview

Traditional credit facilities face significant operational challenges that can limit their efficiency and accessibility. Manual underwriting processes, complex legal documentation and unstructured data management may require large internal teams and third-party intermediaries, along with substantial administrative overhead. These inefficiencies can translate directly to business impact: Borrowers might experience delayed capital access and inflexible terms that constrain growth, while lenders may incur high operational costs that reduce profitability. In emerging markets, these obstacles can be compounded by capital constraints and liquidity shortages.

Current traction

Visa is starting to see emerging onchain credit innovations that enhance credit card programs worldwide. Rain, a stablecoin-linked card issuer based in Puerto Rico, leverages blockchain-enabled lending platforms like Credit Coop and Huma Finance to support the financing of their credit programs. Through Credit Coop, Rain borrows USDC secured by its card receivables, enabling just-in-time funding without the high legal costs associated with traditional warehousing facilities. This approach allows Rain to pay interest only on the borrowed amount, minimizing costs and avoiding excess borrowing for settlement needs. As a stablecoin settlement pilot partner, Rain can borrow daily in stablecoins and settle directly with Visa, streamlining their process.

Protocols like Credit Coop also hold significant potential for scaling credit in emerging markets, where demand often outstrips supply. By boosting operational efficiency and tapping capital from beyond an issuer’s home country, these solutions can expand global credit access substantially.

Moreover, direct settlement with Visa via onchain protocols helps address inefficiencies in emerging markets, where issuers may face multi-day delays in cross-border settlements. This capability enables issuers in emerging markets to scale their credit programs.

Opportunity for banks

Banks can improve their lending operations by leveraging smart contracts and stablecoins to build onchain lending protocols. This has the potential to significantly lower operational costs and improve access to credit globally.

-

-

Overview

The tokenization of real-world assets (RWAs) represents a convergence of traditional finance and blockchain technology that is rapidly gaining traction among leading financial institutions. This process converts physical or traditional financial assets into digital tokens on blockchain networks, maintaining their economic properties while adding programmability and fractional ownership capabilities. Stablecoins play a crucial role in this ecosystem for settlement purposes — enabling efficient trading, lending and yield generation for these tokenized assets.

Current traction

Major financial institutions have moved beyond exploration to actual implementation of tokenized RWAs. For example, asset manager BlackRock launched a tokenized fund called BUIDL that is linked to U.S. Treasury bills and uses USDC for settlement, highlighting stablecoins’ essential role in creating efficient on and off ramps between traditional and tokenized assets. Meanwhile, Franklin Templeton has tokenized several money market funds across many blockchains, enabling near-instantaneous settlement and 24/7 liquidity — capabilities that depend on stablecoin integration. Innovative solutions for tokenizing private credit funds are also emerging, as well as some early examples of tokenized commodities and public equities.

To date, there is over $35.7B of tokenized RWAs onchain, held by over 93K holders globally among 180 asset issuers. Of this, $5B is from tokenized treasuries and $12.43B is from tokenized private credit.¹¹ A McKinsey market report estimates that the base case for the total market size for tokenized assets in 2030 is $2T, with the tokenization of mutual funds and ETFs likely to drive the largest percentage of this growth.¹²

The connection between stablecoins and tokenized RWAs is fundamental, as stablecoins facilitate the settlement of tokenized asset transactions, enabling fast, programmable transfers of value while reducing delays. Additionally, smart contracts that govern tokenized assets often incorporate stablecoins for automated dividend distributions, interest payments and collateralization functions.

Opportunity for banks

By offering customers access to tokenized assets, banks can find improvements in their operational capabilities and client offerings. Specifically, tokenized RWAs can reduce settlement times, lower transaction costs and extend transfer availability beyond traditional banking hours.

Barriers to mainstream stablecoin adoption

Visa stablecoin initiatives

Stablecoin-linked cards

Visa has been a leader in the development of stablecoin-linked cards, enabling consumers and corporates with stablecoin wallets to spend their stablecoins at the 175+ million merchant locations that accept Visa globally.⁵ As banks in emerging markets integrate stablecoins as dollar-denominated accounts, stablecoin-linked cards help add significant utility to their offerings.

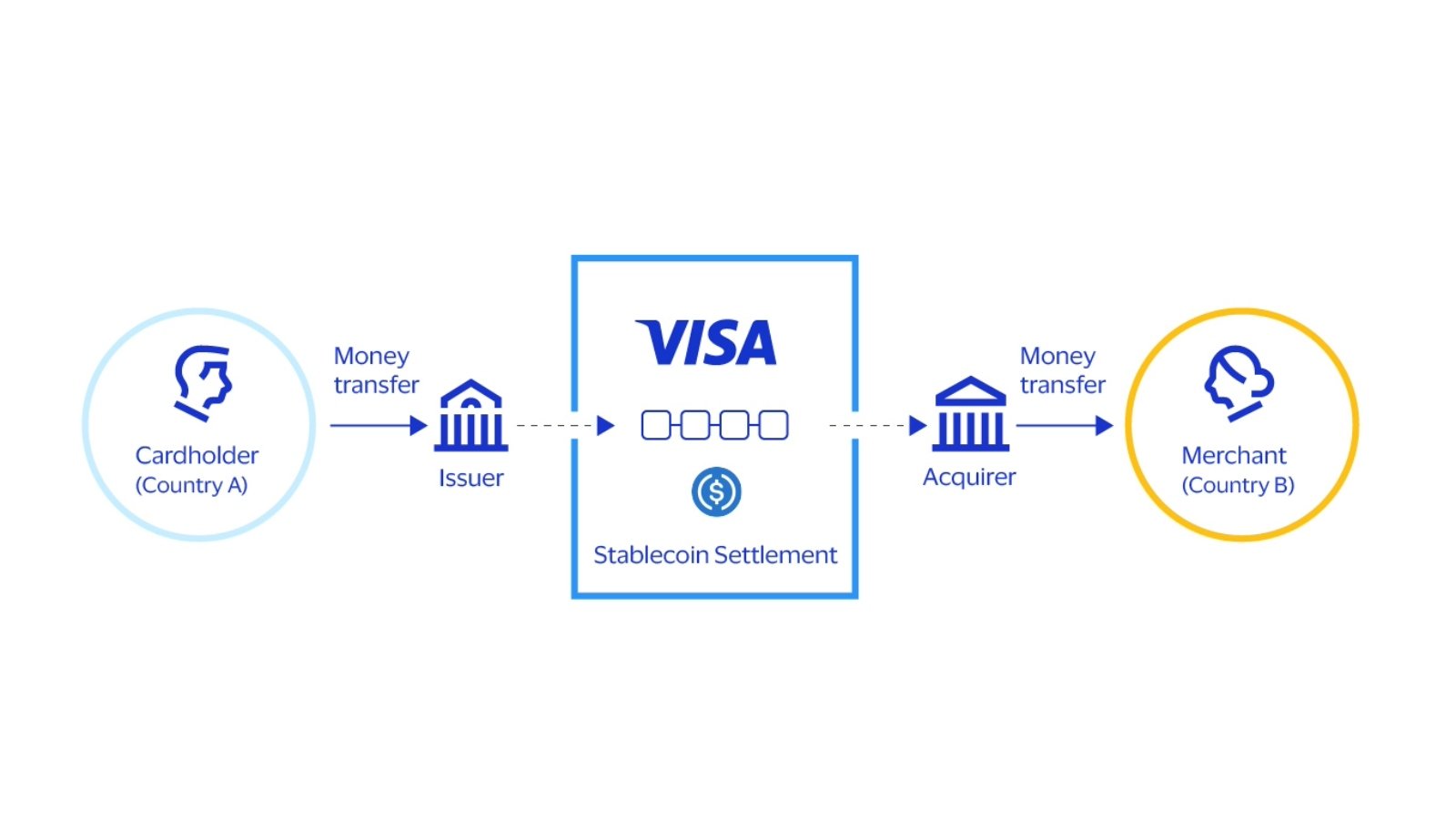

Visa has expanded the flexibility for issuers offering stablecoin-linked card programs by enabling select issuers to settle directly with Visa, using stablecoins seven days a week in a pilot program. For issuers, enabling direct settlement in stablecoins can help reduce friction and create operational efficiencies.

Stablecoin-based settlement flows (pilot)

Stablecoin infrastructure

Visa recognizes that one of the largest barriers for banks to participate in stablecoin activities is access to critical infrastructure, such as stablecoin custody and issuance. With respect to issuance, in October of 2024, Visa released the Visa Tokenized Asset Platform (VTAP) and made it available to limited clients in a sandbox through the Visa Developer Platform, and they also provided the capability for banks to mint, burn and manage bank-issued stablecoins. The platform enables financial institutions to utilize blockchain technology to power new payment solutions. VTAP partner, BBVA, was the first to announce the launch of BBVA-issued stablecoin, with an expected production pilot launching in 2025.

Money movement

Visa is exploring two opportunities in stablecoin-powered money movement: Powering payouts to stablecoin wallets as new endpoints and using stablecoins to facilitate faster account-to-account (A2A) payments into emerging markets. Currently, banks face hurdles to participate in these flows, requiring either ground-up infrastructure development or integration with new third-party platforms. Recognizing stablecoins as one component within a broader payment ecosystem, Visa believes it is important for stablecoins to be integrated into existing fiat money movement platforms.

How Visa can help banks

Data and analytics

Data is essential to building a stablecoin strategy. The Visa Onchain Analytics dashboard offers details on stablecoin trends, and Visa experts can help you unpack the analysis.

- Visa Onchain Analytics Dashboard. April 17, 2025. Data provided by Allium Labs.

- Visa Onchain Analytics Dashboard. Interest revenue estimation based on current rates, stablecoin supply and monthly attestation reserve data for issuers.

- Artemis Analytics Data. April 17, 2025.

- World Bank Group. 2025. Inflation rate average consumer prices annual percentage change map.

- Visa Fact Sheet. September 30, 2024.

- World Bank. Remittance volume based on 2024 TAM estimate from Visa CMS internal data. Blog post.

- World Bank. Remittances Slowed in 2023, Expected to Grow Faster in 2024. Blog post.

- Namita Datta and Rong Chen (with Sunamika Singh, Clara Stinshoff, Nadina Iacob, Natnael Simachew Nigatu, Mpumelelo Nxumalo and Luka Klimaviciute et al.), 2023: “Working without Borders: The Promise and Peril of Online Gig Work.” World Bank, Washington,DC. License: Creative Commons Attribution CC BY 3.0 IGO.

- Atlantic Council. Dollar Dominance Monitor.

- Bridge, a Stripe company.

- RWA.XYZ Data. Sourced April 1, 2025.

- McKinsey. From ripples to waves.

All brand names, logos and/or trademarks are the property of their respective owners, are used for identification purposes only and do not necessarily imply product endorsement or affiliation with Visa.

Product/Ideas in Development

This document is intended for illustrative purposes only. It contains depictions of a product currently in the process of deployment and should be understood as a representation of the potential features of the fully-deployed product. The final version of this product may not contain all of the features described in this document.

This presentation is furnished to you solely in your capacity as a client of Visa and/or a participant in the Visa payments system. By accepting this presentation, you acknowledge that the information, materials and any recommendations contained herein (collectively, the “Information”) is confidential and subject to the confidentiality restrictions contained in the Visa Core Rules and Product and Service Rules or other confidentiality agreements, which limit your use of the Information. You agree to keep the Information confidential and not to use the Information for any purpose other than in your capacity as a customer of Visa or as a participant in the Visa payments system. The Information may only be disseminated within your organization on a need-to-know basis to enable your participation in the Visa payments system. Please be advised that the Information may constitute material non-public information under U.S. federal securities laws and that purchasing or selling securities of Visa Inc. While being aware of material non-public information would constitute a violation of applicable U.S. federal securities laws.

These materials and best practice recommendations are provided for informational purposes only and should not be relied upon for operational, marketing, legal, regulatory, technical, tax, financial or other advice. Recommended marketing materials should be independently evaluated in light of your specific business needs and any applicable laws and regulations. Visa is not responsible for your use of the marketing materials, best practice recommendations, or other information including errors of any kind, contained in this document.

The Information are provided “AS-IS” and intended for informational purposes only and should not be relied upon for operational, marketing, legal, regulatory, technical, tax, financial or other advice. Visa Inc. neither makes any warranty or representation as to the completeness or accuracy of the information within this document or the materials referenced herein, nor assumes any liability or responsibility that may result from reliance on such information. The Information is not intended as investment or legal advice, and readers are encouraged to seek the advice of a competent professional where such advice is required.

The information provided herein is for informational purposes only and should not be construed as financial, legal, or regulatory advice. While stablecoins represent a promising innovation in digital currency, users should be aware that their stability, instantaneity, and cross-border transfer capabilities may vary, and they are subject to regulatory restrictions that differ by jurisdiction. Visa does not guarantee universal acceptance or regulatory compliance of stablecoin transactions, and users should consult with their own advisors to understand the risks and implications before engaging in stablecoin activities.