-

Streamline tokenization at scale

Tokenization offers more seamless and secure ways to pay and be paid.

Use tokenization to secure credentials

Tokenization helps secure digital payments by turning sensitive payment details into unique values called tokens, which can potentially reduce fraud risk and support better customer experiences.

Minimize fraud and increase commerce

Visa offers tokenization solutions that can help improve conversions and save money.

Get a closer look at our integrated solutions

Visa tokenization solutions provide a complete set of capabilities to support your business objectives.

Technology powered by tokenization

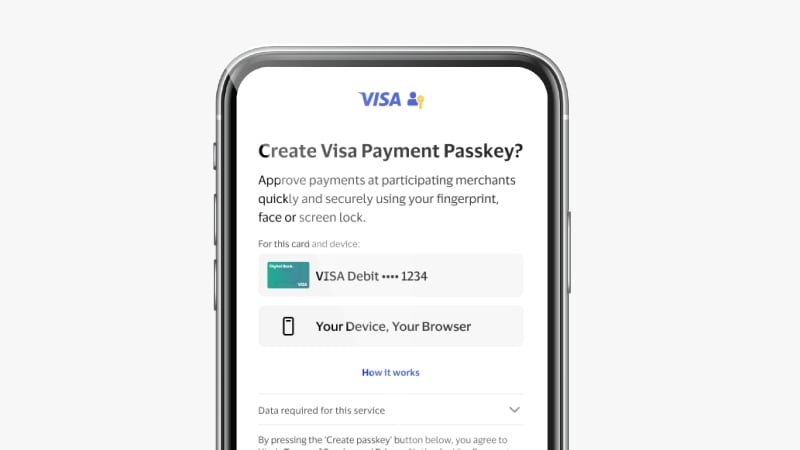

Access passkey authentication

With Visa Payment Passkey, you can enable your customers to use their device passkeys to authenticate payments.

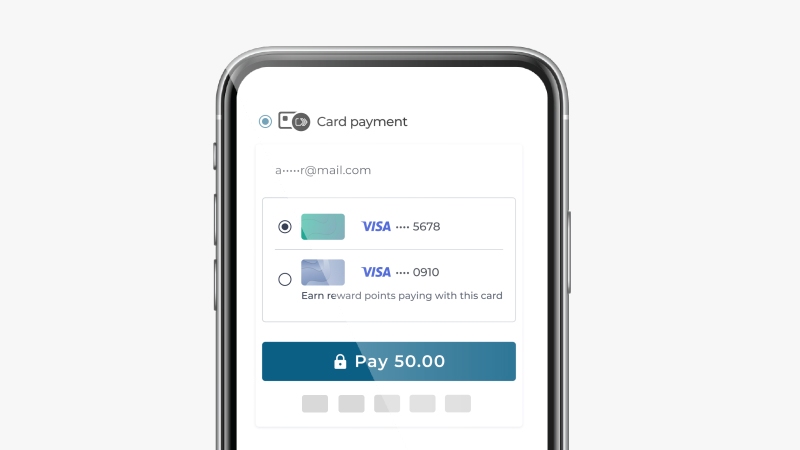

Make online checkout more seamless

Click to Pay helps merchants simplify checkout and financial institutions enhance card utility and deepen cardholder relationships.

See how Visa is moving tokenization forward

Visa is a leader in tokenization. Get expert opinions, in-depth research and useful insights.

-

Tokens e-book

Learn how tokenization works, the different types of tokens and the potential benefits to all parties.

- VisaNet CY2023 credit and debit global card-not-present (CNP) payment volume for tokenized and non-tokenized credentials

- Risk Datamart CY2023, Visa Processed global card-not-present (CNP) payment volume for tokenized vs non-tokenized credentials