The rapid growth of alternative payment methods is transforming the global payments landscape, driven by digitalization, innovation, regulatory changes and changing consumer expectations. From account-to-account (A2A) payments, real-time payments (RTP), and open banking payments to digital wallets, Buy Now, Pay Later (BNPL), and cryptocurrencies, these emerging solutions are reshaping how people and businesses transact.

While these innovations offer greater speed, convenience, and cost-efficiency, they also introduce new challenges for the financial industry, including fraud risks, consumer protection gaps, regulatory complexities, and interoperability concerns.

In this article, Visa Consulting & Analytics (VCA) explores the implications of the rise of alternative payments, the opportunities they create, and the critical challenges that industry stakeholders must address to ensure a secure and seamless payments ecosystem.

A mix of growth drivers and market dynamics drives the emergence of alternative payment methods

Alternative payment methods are rapidly gaining ground worldwide, projected to account for 58 percent of ecommerce transactions by 2028.¹ A key area of growth is A2A transactions, supported by real-time payment networks that make traditional bank transfers a viable alternative.

Initially, these A2A schemes focused on person-to-person (P2P) payments, despite historically being deprioritized due to monetization challenges. Now, the use of these payments has broadened to include ecommerce and physical point-of-sale (POS) transactions.

Depending on market conditions, A2A payments offer various benefits to consumers and merchants:

Convenience – Faster, more seamless checkouts despite inconsistent customer experience due to lack of interoperability

Accessibility – Easier access in emerging markets (e.g., M-Pesa, cryptocurrency schemes); similarly, some methods work internationally without currency exchanges

Speed – Real-time settlement for consumers and businesses (e.g., Faster Payments in the UK), avoiding any delays associated with traditional payment processing

Regulatory, structural, and market-specific dynamics significantly impact adoption rates of alternate payment methods. Successful national A2A schemes often have government and central bank support, as seen with India’s Unified Payment System (UPI) and Brazil’s Pix.

A2A networks thrive in emerging markets with underdeveloped financial infrastructure. Digital wallets and QR code payments offer alternatives to the unbanked and improve A2A payment experiences. QR code payments through digital wallets are also successful in China, where AliPay and WeChat Pay dominate the market.

In bank-centric regions like Europe, successful A2A schemes often involve consortium-led approaches among financial institutions (FIs) and regulation plays an important role supporting new use cases such as variable recurring payments through open banking. Meanwhile, in the U.S., delays and a lack of common standards have led consumers to prefer private digital wallets.

Four main categories of alternative payment methods

Cardless alternative payment methods are diverse and often overlap. Here are four main types:

Rapid growth of alternative payment methods brings challenges around fraud prevention and regulation

As A2A payments gain traction as an alternative to traditional card-based transactions, consumers face new risks that require greater awareness and proactive education from banks and financial institutions.

Four recommendations for FIs

As alternative payment methods gain momentum, banks must take a proactive role in ensuring their safe and responsible adoption. While A2A payments, RTP, open banking payments, digital wallets, and BNPL offer new opportunities for faster and more efficient transactions, they also introduce protection gaps that could leave consumers vulnerable.

Unlike traditional card payments, many of these methods lack built-in safeguards such as chargebacks, standardized dispute resolution, and fraud liability protections, making it easier for bad actors to exploit consumers through authorized push payment fraud, phishing attacks, and account takeovers.

-

Utilize A2A instant payment schemes and digital wallets to digitize cash-heavy use cases, such as P2P transactions and bill splitting, as well as to improve traditional bank transfers, including payroll and business-to-business (B2B) transactions.

Consider partnering with card networks or implementing smart routing logic to minimize the impact on card-related revenue. Use a multi-rail approach for domestic wallets to expand use cases and integrate cross-border payments.

-

Transition from a fragmented payment strategy to a payment hub strategy that supports various rails, including A2A, RTP, and crypto. This would enhance flexibility and adaptability to market changes and demands.

A hub strategy could also enhance scalability, reduce operational redundancies and allow for better data analytics, including AI-driven risk analytics.

This unified payment hub approach would equally support integration of emerging technologies, such as tokenized assets, smart contract-based payments and others.

-

As A2A and open banking payments become more widely used, banks need advanced fraud detection mechanisms that go beyond traditional transaction monitoring.

Investing in AI-driven fraud analytics, behavioral biometrics, and real-time risk scoring will help prevent unauthorized transactions before they occur.

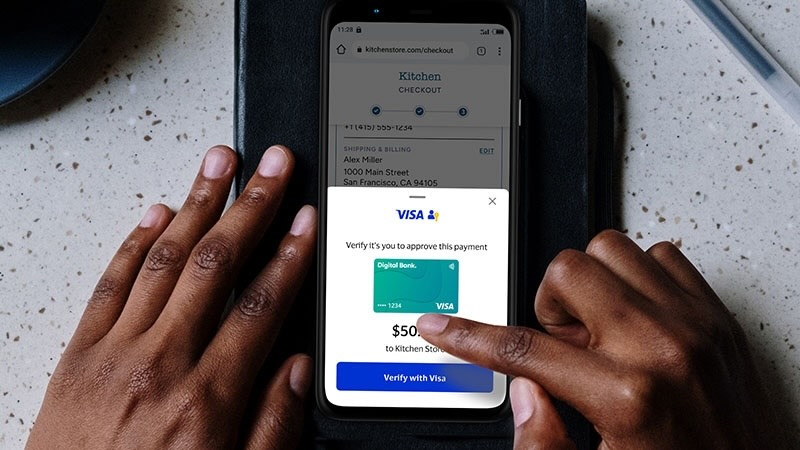

Enhanced Strong Customer Authentication (SCA) and real-time transaction verification alerts can further protect consumers from financial losses.

-

Many consumers are unaware that alternative payments do not always offer the same protections as cards. Banks must lead education initiatives to help users understand the risks, recognize fraud tactics, and make informed payment decisions. This includes embedding real-time fraud warnings into payment journeys, running awareness campaigns, and providing clear guidance on secure digital transactions.

How Visa can help you grow your business

Visa connects our strategy, digital, consumer marketing, and data science experts with your teams to optimize your approach with data-driven, customer-focused services. These include:

Strategic advisory

Understanding customers, identifying opportunities, benchmarking, developing payment strategies and designing solutions.

Implementation support

Building alternative payment propositions via Visa Managed Services (VMS) for Advisory.

Access to Visa tools

Providing access, advice, and support for services like Visa Direct, Click-To-Pay, passkeys, Visa Protect for A2A and Tink's open banking solutions.

Visa Consulting and Analytics (VCA) Insights

Explore our featured insights and case studies to learn how your business can grow, perform and execute.

About Visa Consulting and Analytics (VCA)

With a global team of 1500+ payments consultants, data scientists and economists across six continents, we’re here to help clients improve performance and profitability.

- 2024 Boku Global Ecommerce Report, 2024

- Juniper Research, Digital Wallet Users to Exceed 5.2 Billion Globally by 2026, 2022

- Visa’s new AI tool for Faster Payments could help save UK over £330m a year on fraud and APP scams, May 30, 2024

Forward-looking statements.

This content may contain forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are identified by words such as “believes,” “estimates,” “expects,” “intends,” “may,” “projects,” “could,” “should,” “will,” “continue” and other similar expressions. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict.

Third-party logos.

All brand names, logos and/or trademarks are the property of their respective owners, are used for identification purposes only, and do not necessarily imply product endorsement or affiliation with Visa.

As-Is Disclaimer.

Case studies, comparisons, statistics, research and recommendations are provided “AS IS” and intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice. Visa neither makes any warranty or representation as to the completeness or accuracy of the information within this document, nor assumes any liability or responsibility that may result from reliance on such information. The Information contained herein is not intended as investment or legal advice, and readers are encouraged to seek the advice of a competent professional where such advice is required.

These materials and best practice recommendations are provided for informational purposes only and should not be relied upon for marketing, legal, regulatory, or other advice. Visa is not responsible for your use of the marketing materials, best practice recommendations, or other information, including errors of any kind, contained in this document.