Move money your way

Collect, hold, convert and send funds domestically and cross-border with solutions from a world-leading company and global payment network.

Connect around the world

More endpoints. More currencies. More countries. All accessible through a single connection.¹

Discover how Visa Direct works for you

Visa Direct enables businesses and their customers to streamline money movement and benefit from fast, secure transactions.

A better way to get money in

Collect³ business payments around the world or fund accounts quickly.

- Expand internationally: Receive funds from around the world - there’s no need to set up international accounts.

- Reconcile easily: Give customers peace of mind with automated reconciliation and unique account details that make matching payments to invoices simple.

- Manage costs: With no need for multiple banking partners to receive money internationally, you can save on banking and operational costs. Your customers can save too, by paying in their local currency and avoiding FX fees.⁴

- Enhance speed: Get money into your customers’ hands or your ecosystem fast.

Find solutions made for business. Your business.

Supercharge your business with Visa Direct.

Customize your solution from a full suite of services

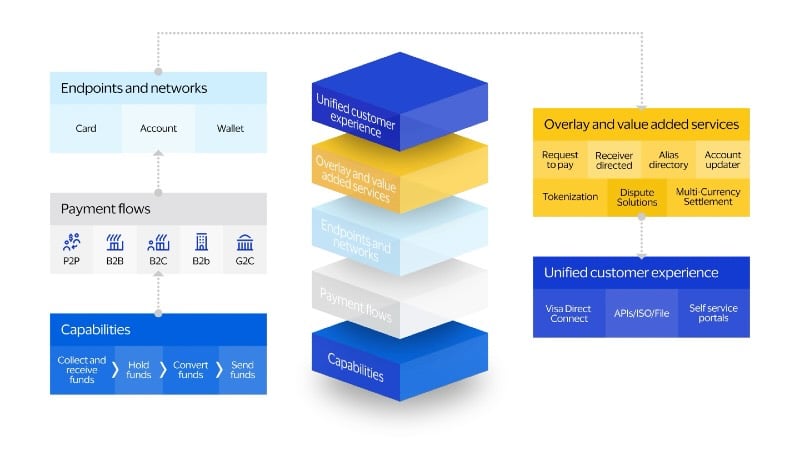

Enable fast money movement to cards, accounts and wallets through a single connection,¹ choosing the value-added services you need to serve 65+ use cases.⁹

About video: Graphic of five colorful cubes fade in and animate into a stack. Animation zooms in and pans left of the bottom cube to a blue callout box: “Capabilities. Collect and receive funds, Hold funds, Convert funds, Send funds.” Animation pans up and left of the next cube, to another grey callout box: “Payment flows. P2P. B2B. B2C. B2b. G2C.” Animation pans up and left of the next cube to a light blue callout box: “Endpoints and networks. Card. Account. Wallet”. Animation pans up and right of the next cube, to a yellow callout box: “Overlay and value-added services. Request to pay. Receiver directed. Visa+ Aliasing. Account updater. Tokenization. Dispute solutions. Multi-currency settlement”. Animation pans down and right of the next cube, to a blue callout box: “Unified customer experience. Visa Direct Connect. APIs/ISO/File. Self-service portals.”

Stay informed and spark ideas

Gain business insights, see what’s on the horizon and identify strategies that can help open up new revenue streams.

- Visa Direct Connect has limited availability and provides connection to select Visa Direct offerings. Please contact your Visa representative for more information.

- Visa Direct clients and participants should always consult and seek approval from their internal compliance teams on sanctions screening controls and processes, and are solely responsible for their own compliance with applicable laws and regulations. Optional compliance controls and risk management tools and services are provided solely for the convenience of sending acquirers, service providers, merchants, and recipient issuers / the Visa Direct clients and participants, and Visa makes no warranties with respect to them or their results. Visa Direct clients and participants are solely responsible for their own compliance with applicable laws and regulations.

- Certain domestic and cross-border collection, currency conversion, hold, and send capabilities offered through the Visa Direct platform are provided by Visa Australia Services Pty Ltd, The Currency Cloud Limited, Currencycloud B.V., Visa Global Services Inc., and Currencycloud Pte. Ltd. Currencycloud provides e-money issuance and/or payment services and is licensed and/or registered in Australia, Canada, the Netherlands, the United Kingdom, multiple states in the United States, and Singapore. Please contact your Visa representative for more information.

- Currency availability may be subject to limitations or change, including but not limited to factors such as client eligibility, jurisdictional limitations, and other factors. Please contact your Visa representative for more information.

- The frequency with which updated FX rates are available varies depending on product, geography, day of the week, holidays, or other factors. Please contact your Visa representative for more information about this program.

- 24/7 availability for the FX service is subject to client eligibility, jurisdictional limitations, and other factors. Please contact your Visa representative for more information.

- Actual fund availability for all Visa Direct transactions may depend on receiving financial institution, account type, region, compliance processes, along with other factors, as applicable.

- Payment tracking services, including SWIFT tracking, are subject to limitations, including but not limited to, capabilities and participation of the sending, intermediary, or receiving institutions.

- Use cases are for illustrative purposes only. Program providers are responsible for their programs and compliance with any applicable laws and regulations.