-

Forrester studies the economic impact of real-time¹ funds disbursement

See the results of a comprehensive study that examines the cost savings and business benefits enabled by real-time¹ funds disbursements.

Visa® recently commissioned Forrester Consulting to conduct “The Total Economic ImpactTM of Real-Time¹ Funds Disbursements vs. Traditional Methods,” a study² that examines the effects of real-time¹ funds disbursements on businesses

Faster payments are reshaping the financial landscape

The increase in person-to-person (P2P) payments has created an expectation for faster payments

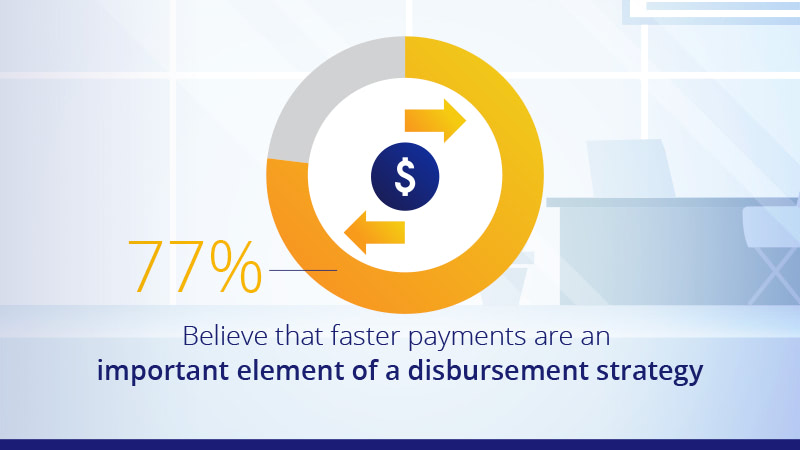

According to the Forrester Consulting study survey, 77% of respondents believe that faster payments are an important element of a disbursement strategy.

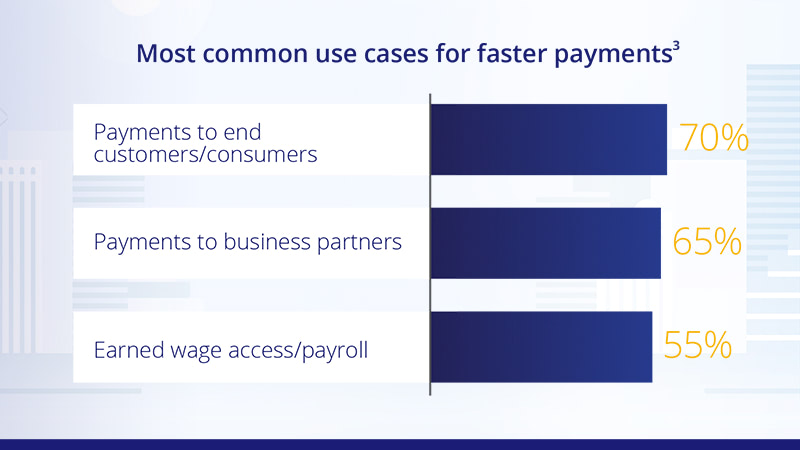

Faster payments can be used for customer, business and employee disbursements

66% of surveyed businesses believe that a real-time¹ funds disbursements program will give them an advantage over their competition. And a vast majority believe they will fall behind their competition if they don't implement a faster payment strategy for payments to end customers/consumers and business partners, or earned wage access to payroll.

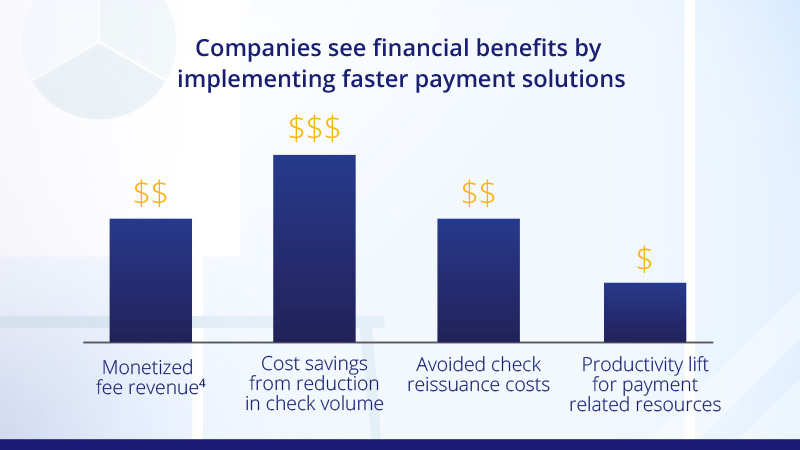

Faster payments can help improve operational efficiencies

According to the study’s financial analysis, both composite organizations would reduce operational costs by adopting real-time¹ funds disbursements. In addition, the composite organization that charges a 1% service fee would generate additional revenue, resulting in a combined benefit of up to $5 million over three years.

A real-time¹ funds disbursement program could pay for itself

Regardless of whether or not an organization charged a service fee, they could quickly see a return on their investment. The composite organization that absorbs the transaction fee could see a 256% ROI over three years, while the organization that charges a 1% service fee could see a 389% ROI.

Start envisioning your money movement future

Discover Visa Direct case studies, research reports, and thought leadership that illustrate how we are pioneering next generation global money movement

- Actual fund availability depends on receiving financial institution and region.

- The study included interviews with Visa stakeholders and customers, as well as a survey of 223 payment managers, which Forrester then used to create two composite organizations for a three-year hypothetical financial analysis with risk-adjusted, present value projections. These organizations shared all of the same characteristics, with the exception of how they handled the cost of transaction fees (one organization would absorb the fees, the other would charge a 1% service fee).

- Use cases are for illustrative purposes only. Program providers are responsible for their programs and compliance with any applicable laws and regulations.

- Organizations that charge a 1% service fee would recognize $1.4M in Monetized Fee Revenue earned over three years resulting in a projected 389% ROI vs. a 256% ROI for an organization that absorbs the fee.

- Information about listed solution providers is provided as a convenience and for informational purposes only, may not include all Visa Direct solution providers, and is based on information provided by each solution provider. Visa is not responsible for the accuracy of such information. All brand names and logos are the property of their respective owners, are used for identification purposes only, and do not imply product endorsement.